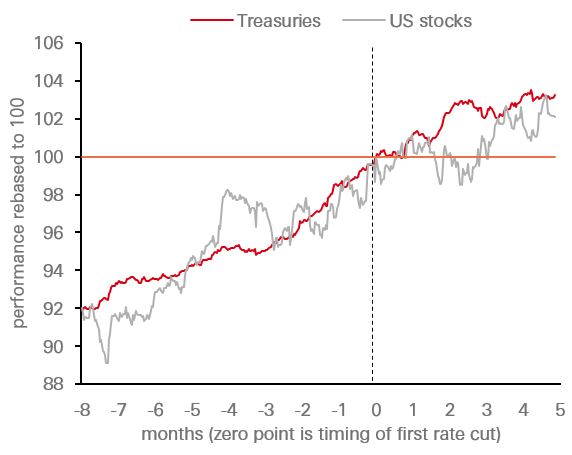

Broad markets indeed outperformed cash in 2023. Cash return of around 5% may appear attractive when compared to the historical cash returns in the period between the Global Financial Crisis and the COVID recession. But the real opportunity cost of cash stems from its relative performance compared to other assets, and these have been substantially higher in 2023. Moreover, with the consumer prices rising around 3.5% in 2023, these nominal returns translate to only 1.5% real return for cash.

As cash rates are the fundamental building block for all asset class returns, an increase in cash rates lifts the total long-term expected returns across all markets: stocks, bonds, and alternatives. Furthermore, the risk premia for government bonds and equity markets increased in 2023, boosting their potential for outperformance in the future. It is important that investors should not evaluate investment opportunities (such as cash) in isolation but against alternative opportunities, and to consider the prospective real returns rather than nominal only.