The secret connection between resilience, risk, and portfolio diversification

Written in collaboration between HSBC and the Wellbeing Research Centre at the University of Oxford.

Key takeaways:

- Financial resilience, the ability to recover from financial setbacks, is strongly linked to overall Quality of Life.

- Highly resilient individuals tend to have more diversified investment portfolios. Building a diversified investment portfolio as part of an overall wealth plan can provide protection and better equip individuals to manage unforeseen setbacks.

- Having a solid financial plan, access to financial resources, and increasing financial knowledge are key ingredients for improving Quality of Life.

For many of us, our daily routines have changed profoundly over the last few years. An increase in remote or hybrid work and limited social interactions during the pandemic, have led us to re-evaluate what truly matters: our Quality of Life.

HSBC research shows that financial resilience, or the ability to recover from financial setbacks, is strongly linked with our Quality of Life as it provides peace of mind and a layer of financial security.

Having a financial plan is crucial for building financial resilience and the HSBC Quality of Life Report 20241 also shows that portfolio diversification plays a significant role in managing our finances effectively, improving our Quality of Life.

A framework for financial resilience

Resilient financial planning and a better Quality of Life go hand-in-hand.

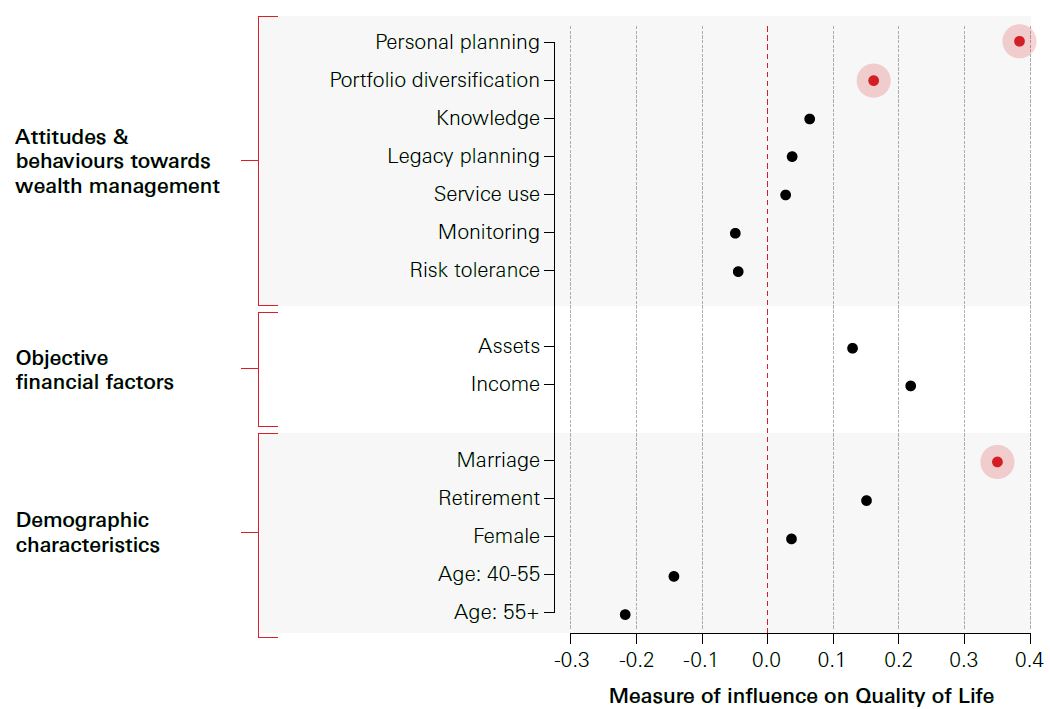

According to HSBC’s Quality of Life research, attitudes and behaviours towards financial planning emerge as the most critical factor influencing our Quality of Life. Surprisingly, personal planning even surpasses the influence of marriage on our well-being.

Comprehensive financial planning and having the right insurance can reduce financial stress and increase financial resilience. Having the right protection and plan in place can provide a safeguard that enables us to focus on what truly matters – living our lives to the fullest.

Potential determinants of Quality of Life

By having a solid understanding of portfolio diversification and risk management, people can become more financially resilient and open to exploring new opportunities. Ultimately, this can improve their sense of well-being and Quality of Life, while also helping to protect against unforeseen financial difficulties later in life.

Dr Caspar Kaiser, HSBC Research Fellow at the University of Oxford’s Wellbeing Research Centre

Prioritising peace of mind

Highly resilient individuals tend to have more diversified investment portfolios.

Resilience, which encompasses financial, mental and physical confidence and the ability to manage change, contributes significantly to our overall Quality of Life. The research indicates that financial resilience is closely associated with greater portfolio diversification, while the connection to mental and physical resilience is comparatively less pronounced.

By building diversified investment portfolios as part of an overall wealth plan, individuals feel protected and better equipped to manage unforeseen setbacks. As a result, they rate their Quality of Life higher.

People also placed a high importance on financial planning as an influence on their Quality of Life - even more so than actual assets and levels of wealth. This shows that ultimately, a sense of security is more important than the level of wealth.

Taking control of your wealth plan

Our Quality of Life improves when our financial knowledge increases.

When it comes to determining your Quality of Life, having a solid plan and access to financial resources are key ingredients for success. Building a strong wealth strategy entails having access to the right information and expert guidance. Being armed with the right knowledge can lead to stronger financial decision-making.

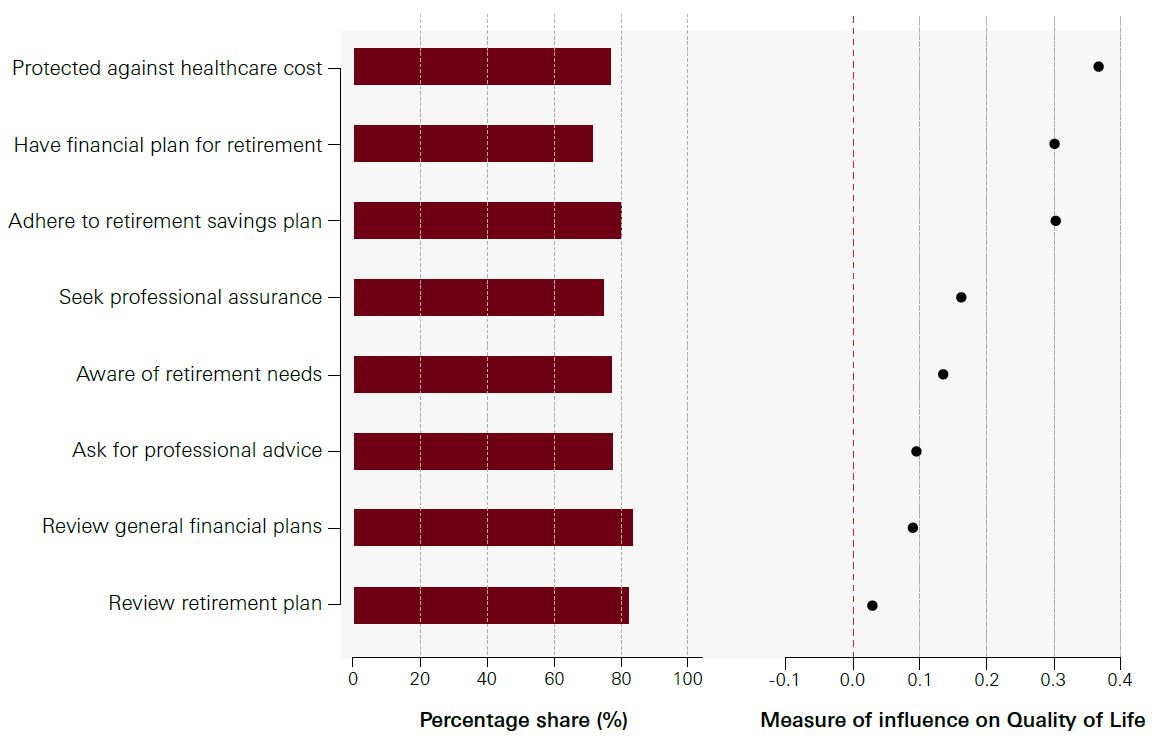

Zooming in on personal planning

Percentage share of individuals answering ‘yes’ to various components of financial planning, and how each component is associated with overall Quality of Life.

A key aspect of effective wealth management is diversification. Research has shown that including a broader range of investments in a wealth portfolio can help create a solid financial foundation that supports both stability and growth. By embracing a broader range of investment opportunities, individuals can position themselves for long-term success and better navigate the ever-changing world of finance with confidence.

Jan-Marc Fergg, Global Head of ESG & Managed Solutions, HSBC

Early investment

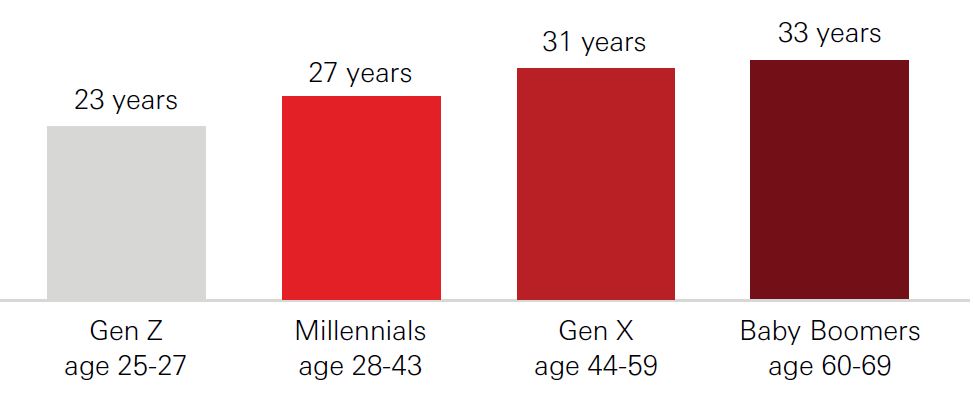

Younger generations are starting to invest earlier

Average age to start investing

The HSBC Quality of Life Report 2024 highlights the significance of investing early. Gen Z and Millennials, on average, start investing earlier (at 23 and 27 years old, respectively) than Gen X (31) and Baby Boomers (33). The report also reveals that they invest a higher portion of their income and tend to monitor their portfolios more frequently. This active interest in investing contributes to a sense of control and well-being.

Practical steps to boost your financial well-being

Your Quality of Life could be improved with a robust financial plan. Consider these five practical steps when planning the financial future for yourself and your loved ones.

1. Improve your financial knowledge

Take the time to understand the various investment options available to you. This knowledge could empower you to make informed decisions about your portfolio and financial plan. Building a firm understanding of wealth management helps lay a solid foundation for future financial security.

2. Start investing

Think big, start small. One of the key steps towards securing your financial future is to start investing. After assessing your financial goals and risk tolerance, take the first step on your investment journey.

3. Explore diversification

Investing in a variety of markets or asset classes could help you capture opportunities and be more resilient against market volatility.

4. Make a financial plan

Consult with financial specialists and establish a plan, then review it regularly to ensure it covers your present and future needs.

5. Regularly review

Your Quality of Life can decline as you go through different stages of life. Making sure you are covered for potential setbacks with a robust financial plan can help you ride out any future bumps in the road.

Seeing the connection between resilience, portfolio diversification and Quality of Life is crucial.

By understanding the importance of resilient financial planning, individuals can become more financially secure and prepared for the future, able to embrace new opportunities with more confidence.

Prioritising peace of mind and taking practical steps to enhance financial knowledge can help establish robust plans and raise overall Quality of Life. By adopting these strategies, individuals can navigate uncertainties with increased confidence, paving the way for a more secure and prosperous future.

Getting Started with Investments

Create an investment strategy in simple steps

Wealth Insights

Read our latest insights curated to meet your investment and wealth needs

Related Insights

[Meet life goals] The Power of Portfolio Diversification

Diversification involves spreading your investments across a wide range of assets to...[19 Jun]

[Meet life goals] Why should I invest, especially now?

We surveyed over 11,000 affluent individuals across 11 markets and asked some simple yet...[5 Jun]

[Start Investing] Why Securitised Credit?

This article aims to provide you with a general understanding about Securitised Credit.[9 May]

Notes

1. The HSBC Quality of Life Report 2024 interviewed over 11,230 individuals across 11 different markets to understand what they consider to be a good Quality of Life. The report uncovers the connections and balance between physical and mental wellness with financial fitness and how they differ between generations. It also explores 4 main priorities shaping how people plan and prepare for their short, medium, and long-term life goals.