How financial planning helps protect against future challenges

Written in collaboration between HSBC and the Wellbeing Research Centre at the University of Oxford.

Key takeaways:

- Financial planning has a significant long-term impact on our well-being, even more so than a pay rise or existing wealth assets.

- Seeking professional advice and building a financial plan can protect against future losses and positively impact our well-being.

- Financial planning not only benefits us in the present but also future generations. By organising our wealth to provide for our loved ones, we can leave a lasting positive legacy.

It’s crucial we prioritise our Quality of Life – to focus on what truly matters and take steps to enhance our overall well-being. So what defines our Quality of Life? Our research shows that Quality of Life is determined by our physical and mental well-being, as well as our finances, relationships and overall happiness.

Furthermore, our research suggests that financial planning – and the peace of mind it brings from guarding against future losses – has a significant long-term impact on our well-being than a pay rise or existing wealth assets.

In this article, we will explore how effective financial planning contributes to our overall Quality of Life, from providing a sense of security to enabling us to make the most of life’s opportunities.

Impact on our well-being

Financial planning involves developing strategies to manage your financial affairs and achieve your life goals. Poor financial planning can have a tremendous impact on our Quality of Life. Whether it’s saving for a down payment on a house, planning for retirement, or funding our children’s education, having a clear roadmap can make all the difference. Financial planning empowers us to take the necessary actions to turn our dreams into reality.

Recent research conducted by HSBC shows that financial planning is more important for our Quality of Life than accumulating wealth. When we take the time to actively manage our finances and protect ourselves and our loved ones against risks, we can create huge benefits to our long-term happiness. With a comprehensive financial plan in place, we can face uncertainty with confidence, knowing that we have prepared for the future.

When it comes to wealth management, people value certainty and security above everything else – planning for and protecting ourselves, our loved ones and the next generation. By making a financial plan for the future, we are also helping to secure our Quality of Life in the present.

Jenny Wang, Global Head of Personal Banking and Premier Wealth Solutions, HSBC

The benefits of being prepared

Most people have a wide range of financial goals.

For some, a secure retirement is the top priority; others dream of owning a home, or providing their child with an overseas education.

The HSBC Quality of Life Report 20241 suggests that seeking professional advice and building a financial plan can help protect us against future losses and positively impact our well-being. Actively managing our finances and investments, seeking professional guidance, and having a comprehensive retirement plan can help establish a solid foundation for a fulfilling and enjoyable life.

Effective planning requires more than just a general review of our financial situation A more proactive, forward-thinking approach is required. To ensure that financial plans remain on track, we should regularly engage with a professional financial adviser to review our circumstances, needs and objectives.

Provide for future generations

The value of financial planning goes beyond our immediate needs and extends to the long-term opportunities it can offer to our loved ones. HSBC research found a positive link between our Quality of Life and how well we organise our wealth to benefit the next generation. By considering legacy planning as part of a financial strategy, we can leave a lasting positive impact and ensure that our loved ones are provided for and protected.

Professional advice paints a clearer picture

While financial planning can seem overwhelming, seeking professional advice can make the process easier and provide clarity.

HSBC research showed that people who seek guidance from a professional can enjoy a better Quality of Life. By seeking professional guidance, constructing comprehensive financial plans, and safeguarding against future uncertainties, individuals lay the foundation for a secure and prosperous future.

Securing your financial future can seem challenging. HSBC research suggests that with professional advice, people can build and maintain a financial plan that delivers long-term peace of mind.

Dr Caspar Kaiser, HSBC Research Fellow at the University of Oxford’s Wellbeing Research Centre

Protection

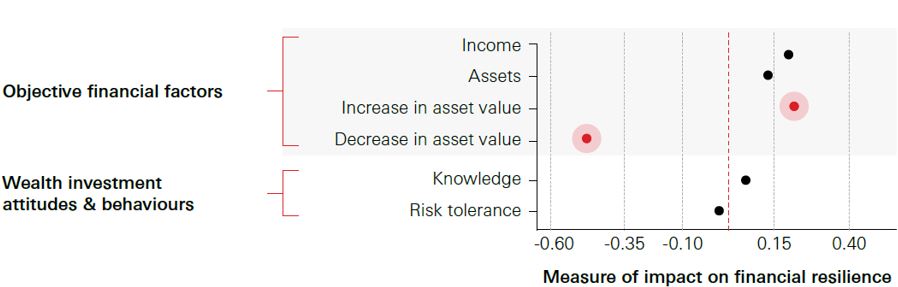

Though life is full of uncertainties, financial planning can help safeguard us against unforeseen circumstances. It is a well-known fact that we are more commonly affected by monetary losses than by personal gains. This can be seen in the data where the negative impact of a decrease in asset value is significantly larger than the positive impact of an increase in asset value. This tendency is called ‘loss aversion’.

Potential determinants of financial resilience

Percentage share of individuals answering ‘yes’ to various components of financial planning, and how each component is associated with overall Quality of Life.

Build wealth

In addition, proper financial management can help us build wealth over time. By making informed investment choices and maximising our savings, we can grow our assets and increase our net worth. Increased financial security opens up opportunities for us to enjoy life to the fullest, whether through travelling, pursuing hobbies, or supporting causes we care about. A good financial plan enables us to create a brighter future for ourselves and our loved ones.

Protecting ourselves from financial setbacks is crucial to building financial resilience, and having the right insurance coverage can provide a safety net for our financial well-being. By understanding our insurance needs and ensuring we have adequate coverage, we can protect ourselves and our families from financial burdens that may result from unexpected events.

Winnie Ching, Global Head of Product, HSBC Global Insurance

Practical steps to boost your financial well-being

Map out your goals

What are your future financial needs? Buying a house, getting married, sending your kids to study abroad or saving for retirement? Mapping out these potential expenses helps you gain a clearer picture of your situation.

Identify any budget gaps

Look for any possible shortfalls in your budget and think about ways to fill the funding gaps or reorganise your spending.

Seek advice

Expert advisers provide clarity by reviewing your overall situation. They can help you build a financial plan to meet your current and future goals.

Review and revise

Life doesn’t stand still, and neither do our finances. Regularly review and adjust your financial plan according to your changing needs.

As we navigate the complexities of modern life, it is crucial to prioritise our Quality of Life. Recognising the role of financial planning in enhancing well-being is a pivotal step towards a more fulfilling life. From providing peace of mind to helping us achieve our goals and build wealth, planning allows us to take control of our finances and create a better future for ourselves and our loved ones. By making wise financial decisions and prioritising our values, we can enjoy a life of financial well-being and fulfillment.

So start planning today. Speak to one of HSBC’s financial experts to learn more about the incredible potential that financial planning holds.

Learn more on habits for financial wellbeing

HSBC Wealth management helps you to achieve your goals

Related Insights

[Meet life goals] Peace of mind through diversification

Financial resilience, the ability to recover from financial setbacks, is strongly linked...[2 Sep]

[Meet life goals] The Power of Portfolio Diversification

Diversification involves spreading your investments across a wide range of assets to...[19 Jun]

[Meet life goals] Why should I invest, especially now?

We surveyed over 11,000 affluent individuals across 11 markets and asked some simple yet...[5 Jun]

Notes

1. The HSBC Quality of Life Report 2024 interviewed over 11,230 individuals across 11 different markets to understand what they consider to be a good Quality of Life. The report uncovers the connections and balance between physical and mental wellness with financial fitness and how they differ between generations. It also explores 4 main priorities shaping how people plan and prepare for their short, medium, and long-term life goals.