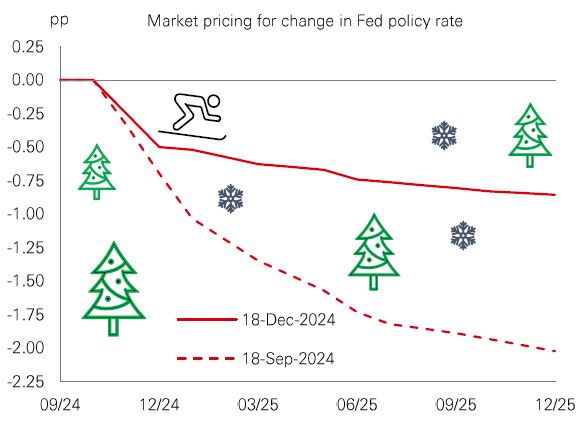

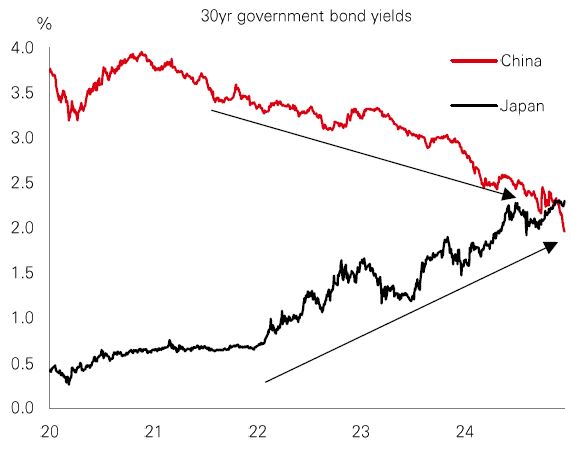

The story of investment markets in 2024 has been dominated by the course of disinflation and the global rate-cutting cycle. Last week’s sell-off in global stocks on a more hawkish Fed outlook showed how hyper-sensitive markets are to disappointing macro news. But Q4 has delivered some extra twists and turns, including the outcome of the US presidential election. The result raised uncertainty over future US policy, spurred strong moves in global risk assets, and drove a rally in the US dollar. It even got some credit for a surge in the price of cryptocurrencies.

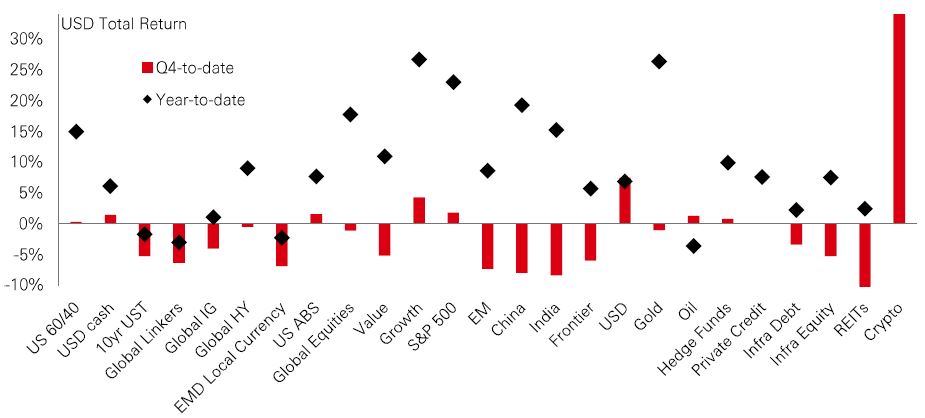

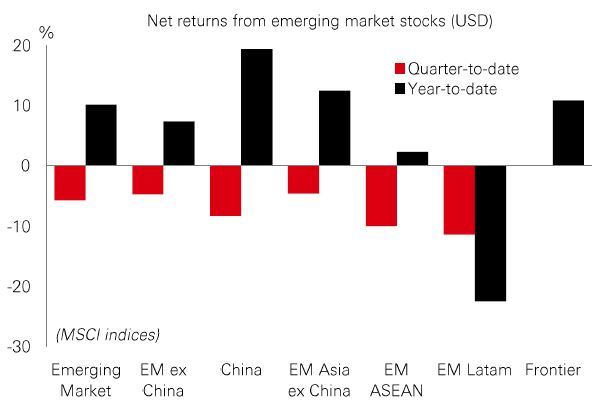

In stocks, the strongest momentum has been in US large caps, especially in tech-related sectors. Despite last week’s moves, the S&P 500 is still up in Q4 (and up by more than 20%+ this year). Growth has thrived while value has lagged. But it was emerging market equities – which have been strong in 2024 – that felt the most pain in Q4 (see Page 2).

In fixed income, the potential for inflationary policy and higher-for-longer rates saw US Treasury yields rise. In credit, High Yield and ABS were more muted in Q4 (but have been strong in 2024 overall). Meanwhile in alternative assets, Q4 was weak but diversifiers like hedge funds, private credit, and real estate are on course to finish the year positively.

So, what comes next? We think that active fiscal policy, trade uncertainty, and geopolitical tensions may cause volatility and could leave investors ‘spinning around’ in 2025. And despite the moves in Q4, there is scope for performance to broaden out to developed markets beyond North America, as well as emerging and frontier markets next year (see Market Spotlight).