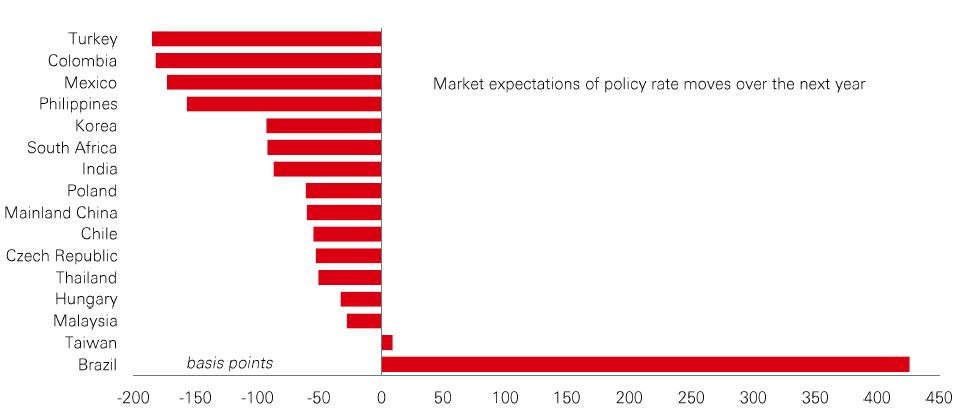

An interesting divergence in fiscal policy has emerged between a number of frontier and mainstream emerging markets – with previous fiscal “saints” and “sinners” switching roles. Some formerly fragile frontier economies have been embracing reforms, and boosting their sustainability metrics, just as several EMs have seen a deterioration.

Frontier markets like Argentina, Ecuador, Ethiopia, Kenya, Nigeria, Pakistan, Sri Lanka, and Turkey have adopted reforms (often supported by IMF programs) aimed at mitigating vulnerabilities. Policies have included ending FX market distortions, reining in public debt by targeting primary surpluses, and accumulating foreign exchange reserves.

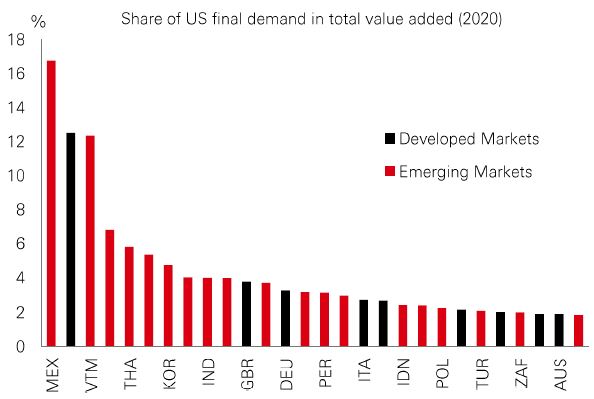

Meanwhile, some mainstream EMs usually associated with stronger macroeconomic fundamentals and better institutional credibility have been pursuing looser fiscal policies – leading to a widening of budget deficits. Prominent examples include Brazil, Hungary, Indonesia, Mexico, Poland, and Thailand.

In many cases, these looser policies have been deployed to stimulate domestic growth, and active fiscal policy will be a key feature of the global macro environment in 2025. For investors, it’s a further reminder that selectivity will be important in finding opportunities in EM and FM markets.