Are good economics now bad politics? Recent developments in France are a case in point. IMF forecasts show the country’s public finances are on an unsustainable path, with the debt ratio expected to reach almost 130% of GDP by the end of the decade. But with the French parliament split into three blocs, there is limited political will to find a solution. French Prime Minister Barnier’s proposed EUR60bn budget consolidation saw him swiftly ejected from office.

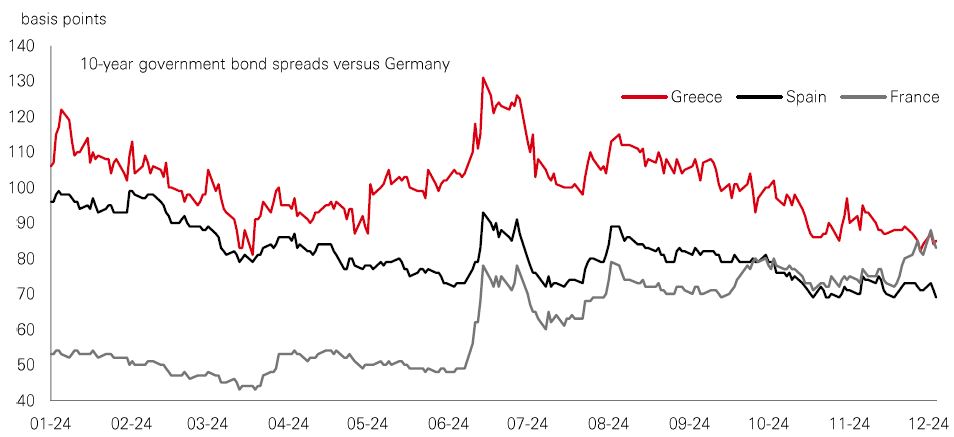

Amid the political impasse, France’s 10-year government bond spread over Germany has moved higher, and is now above that of Spain and Portugal. Yet, this is not a marker of an imminent crisis. In the words of financial wags, it's not a “Truss moment”. Spreads in France have not blown out in the same way they did in the UK in September 2022, when then-Prime Minster Truss introduced a budget that incorporated significant unfinanced tax cuts, worsening debt sustainability. No such measures are being touted in France for the time being.

The market reaction to last week's events in France has been sanguine. That reflects today's better economic reality versus 2022 – ongoing disinflation, central bank rate cuts, and decent global growth. The ECB also provides an ultimate backstop against disorderly market dynamics in the eurozone via the Transmission Protection Instrument (TPI), even if this comes with strings attached. So, although events require monitoring, and the distinction between the eurozone core and periphery is blurring, this is likely to be a slow-burn issue rather than the start of a new crisis.