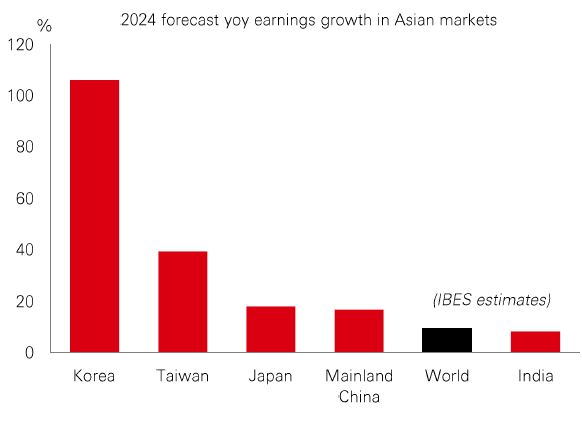

Asian stock markets have delivered decent performances this year, with mainland China and India setting the pace. But as Asia’s Q3 earnings season rolls on, we’ve seen regional variations in terms of sector winners and losers.

Technology-led markets in South Korea and Taiwan are still the region’s profit engine. Strong demand in industries like semiconductors and hardware has been potent, particularly in South Korea, which has seen a strong rebound in profits growth. In Japan, Q3 has also been solid, with financial stocks the big driver on improving margins. But its discretionary stocks have lagged, with profits falling among automakers. In mainland China, financial stocks (particularly insurance firms) have underpinned robust Q3 profits growth, and firms in hardware and e-commerce have been strong too.

By contrast, profits in India have surprised to the downside. But weak macro momentum in the quarter is expected to recover, and sectors like financials, healthcare, and real estate have performed well. Overall, some specialists continue to see fair valuations across the region, as well as solid growth and appealing economic diversification.