Investors remain in good spirits post-election, with US stocks steadying after previous week’s big rally. Many crypto assets are hitting new highs, and credit spreads have ground lower to record tights. Potential policy changes – in the form of lower corporate tax rates and deregulation – have given markets a fresh catalyst. Does this extend the trend of “US exceptionalism”?

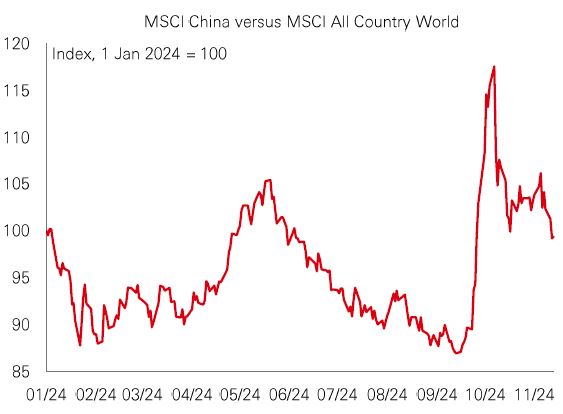

Some analysts don’t think investors should give up on the broadening out trade. The US economic growth premium is still expected to shrink in 2025, and profit growth will be more evenly distributed across the globe. There is still a big valuation case for EAFE and EM stocks. That means that any better-than-expected news can be doubly good news for market performance.

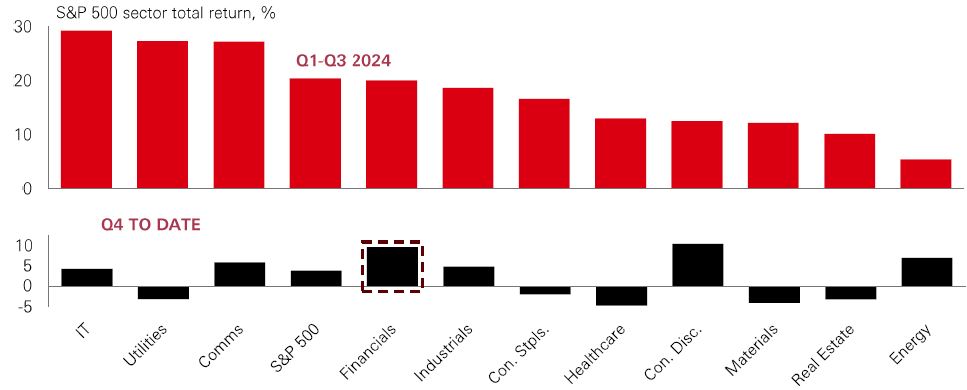

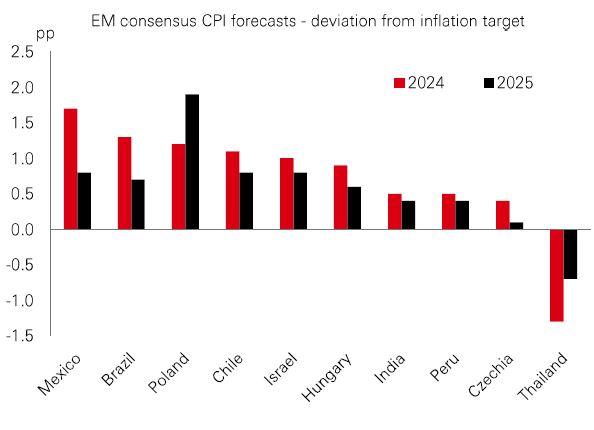

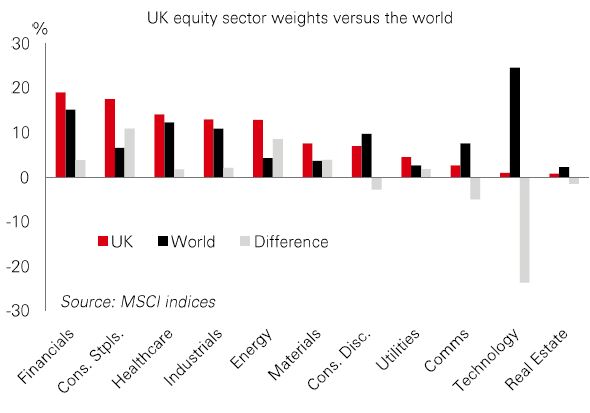

But rising policy uncertainty weighs on the global outlook. What’s more likely, therefore, is broadening out at the sector and factor level. In the US, we’ve seen signs that the market is prepared to look beyond the technology sector, with financials and energy performing strongly this quarter on the prospect of a regulatory overhaul. And in an environment characterised by still-high inflation, a shallower cutting cycle, and economic expansion, neglected parts of global stock markets – such as value stocks – could catch up. In 2025, a multi-factor, multi-sector approach could work best.