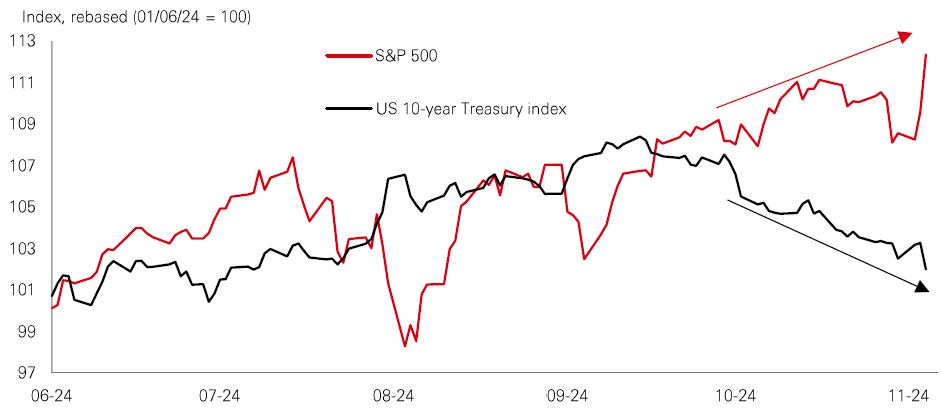

The S&P 500 hit fresh all-time highs last week with the decisive outcome of the US presidential election removing one form of uncertainty for investment markets. US stocks also found a fresh catalyst via the potential for lower corporate tax rates and deregulation, boosting the profits outlook.

The recent good run in US stocks has coincided with a period of rising US Treasury yields. Investors are grappling with a likely combination of ongoing fiscal activism, global economic fragmentation, renewed inflationary pressures, and a shallower Fed rate cutting cycle.

So far, the stock market has shrugged off the pick-up in yields. But there is no guarantee that higher-for-longer rates won’t damage risk appetite. Investment markets have been “hypersensitive” to economic news this year. The addition of policy uncertainty could intensify market volatility.

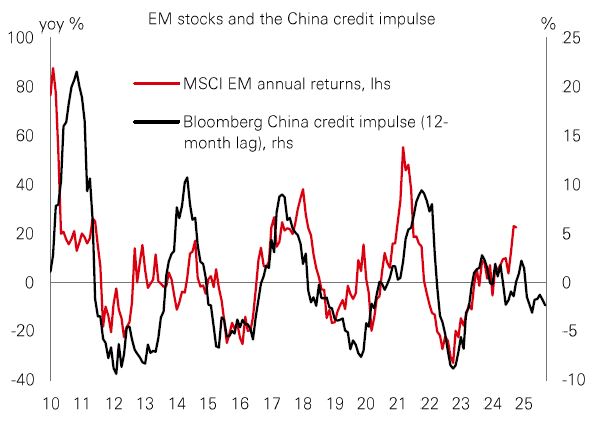

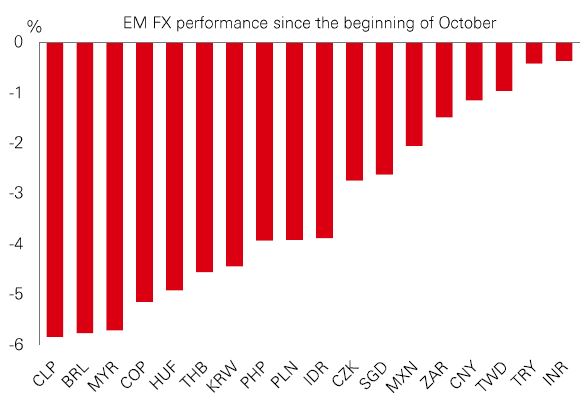

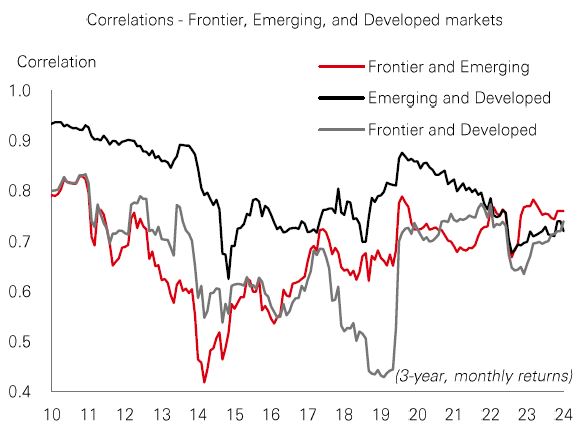

US stock valuations look stretched and profits expectations are elevated. Positive European and Asian growth in 2025 suggests there is still room for markets outside of the US to perform. But for emerging markets, the dollar outlook is key, as is the next set of policy support measures from China.