Three things about the capital markets stand out. First, a medium-term economic regime of more volatile inflation and a new fiscal/monetary policy mix raises the assumption for interest rates. And that reinforces the appeal of core fixed income and the ‘all-in’ yields from ‘senior’ credit asset classes like infrastructure debt, asset-backed securities, and global investment grade.

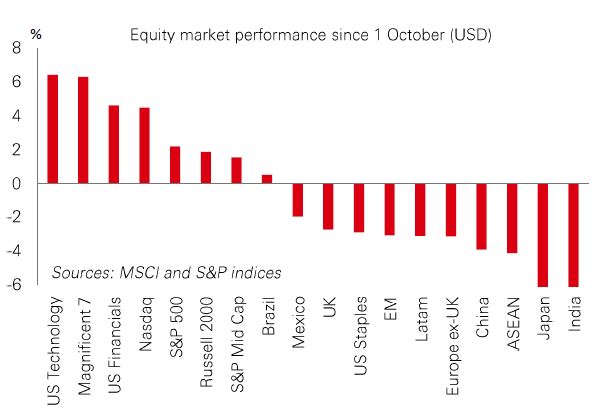

Second, the most compelling valuation anomaly today is in emerging markets. EM fixed income and equity returns look higher than in most of the G7. Opportunities in India, North Asia, and frontier markets stand out, as do themes in local currency EM bonds.

Third, as the economic environment becomes more uncertain, there needs to be a larger role for private markets and other alternatives. That means focusing on diversifiers like hedge funds or commodities, the double-digit yields in private credit and infrastructure equity, and the emerging value in real estate and private equity.