28 October 2024

Nearly one-third of S&P 500 firms have reported results for Q3, with the analyst consensus looking for year-on-year earnings growth of 3.5% overall. So far, progress looks good.

Sovereign bond investors are in a jittery mood ahead of the UK Chancellor’s inaugural Budget on 30 October.

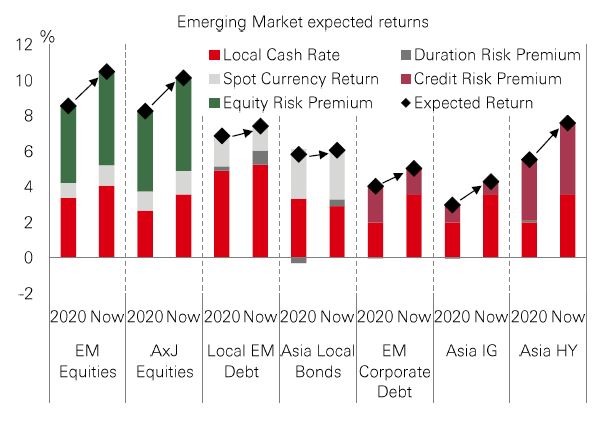

EM expected returns look good. The risk premia for asset classes like stocks, EM local-currency bonds, and Asia high-yield bonds are elevated because policy rates are expected to be a bit higher over the next decade.

Last week’s jamboree of finance chiefs and policymakers at the annual meetings of the IMF and World Bank in Washington confirmed what many investors already know; inflation is in retreat and global growth remains impressively resilient. The soft landing is here.

For the US, UK, Japan, Southern Europe, and some Emerging Markets (EM), the IMF has upgraded its 2024 scenario. It’s a triumph for central bankers. But the challenge for investors, of course, is assessing how much of this good news on the economy is already priced in.

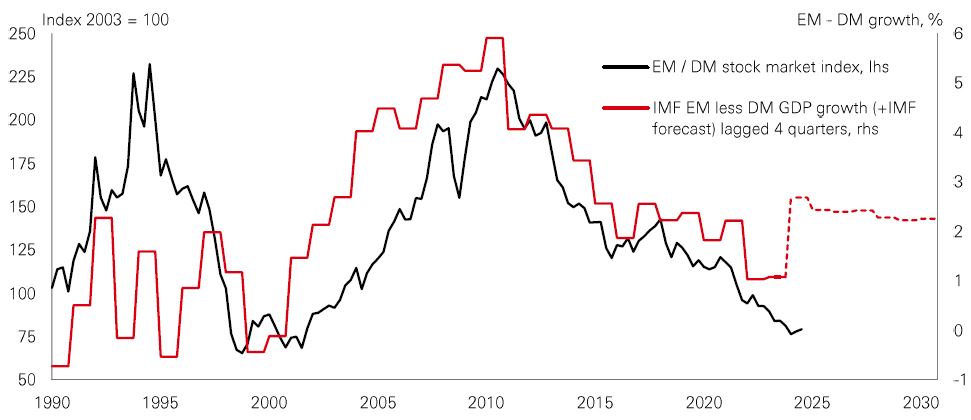

Heading into 2025, global growth is forecast to continue at 3.2%, adjusted for inflation. US growth is expected to be more normal, at just over 2%. Europe is projected to pick up, with the cost of living shock fading, to 1.2% in the eurozone and 1.5% in the UK. And EM economies are expected to grow at 4.2% on average – with country differences. Asia looks best placed in EM, with 2025 GDP at 5%. India is still expected to be the fastest growing major economy in the world (IMF forecasts 6.5% GDP in 2025). And frontier economies are also projected to grow strongly next year.

Faced with this macro scenario of the major economies drawing closer together in their growth rates, investors might well ask whether the era of “US exceptionalism” is coming to an end? Can Europe, Australasia, and the Far East (EAFE) and EMs go from being market laggards to leaders, and outperform the US?

We’ve seen a rotation in global stock markets this year, and the new analysis of September’s performance sheds light on where that’s been happening.

Quant multi-factor strategies work by weighting to ‘factors’ like Quality, Value, Momentum, Size (smaller-cap) and Low Risk. So, their performance explains a lot about changing trends in market sentiment.

This year, with so many previous winners (especially in the tech sector) still outpacing the market, Momentum has been strong. But with the Fed cutting rates in September, we saw a shake-up of factor returns during the month. The defensive Quality factor performed best, setting the pace in North America, Asia Pacific ex-Japan, and emerging markets. The market leadership is broadening out across sectors as global policy easing continues and central bankers seek to make the soft landing stick. And with the cyclical Size factor also relatively strong in North America, Europe, and EMs in September, it showed that smaller-caps are very much part of that rotation mix, too. Value ranked in the middle of factor returns globally, but it did perform well in Europe – hinting that investors are feeling more confident about looking beyond US markets for opportunities.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 25 October 2024.

Nearly one-third of S&P 500 firms have reported results for Q3, with the analyst consensus looking for year-on-year earnings growth of 3.5% overall. So far, progress looks good.

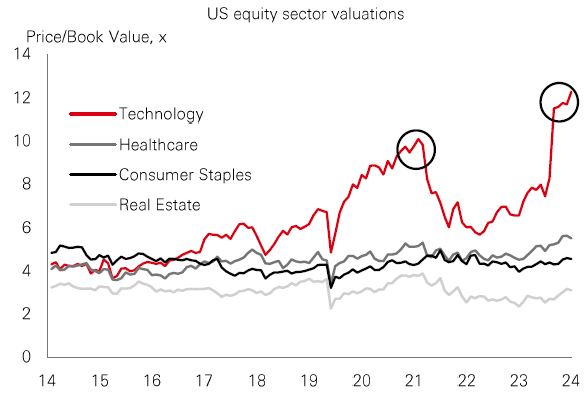

Three of the top five earnings growth contributors in Q3 are expected to be Tech firms, with the other two in Healthcare. Based on results versus expectations, Tech, Real Estate, Financials, Staples, and Healthcare have all come in better than average. But Energy and Materials have been at the lower end.

Tech companies are expected to dominate the earnings pie for several quarters to come, but a lot rests on high expectations. The S&P Tech sector currently trades on a trailing price-book value of 12.3x. That’s higher than before the sharp sector sell-off in 2021 (see chart) and surpasses its previous all-time high of 12.1x in 2000. As a comparison, Tech stocks are up by nearly 600% over the past decade, while Real Estate and Consumer Staples are up by only 40% and 60% respectively. With continuing signs of a rotation in sectors and styles, stretched Tech sector valuations demand caution.

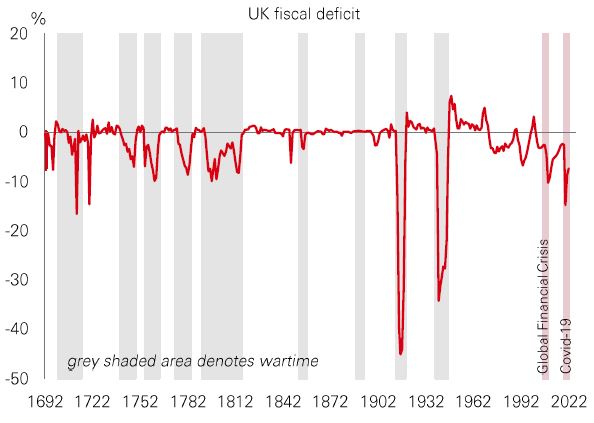

Sovereign bond investors are in a jittery mood ahead of the UK Chancellor’s inaugural Budget on 30 October. Like many developed and EM economies, the UK’s parlous fiscal position is a major challenge. The fiscal deficit is at levels usually associated with wartime, while the net debt/GDP ratio has risen to just shy of 100% in 2023, with the IMF expecting that to worsen.

Higher GDP growth would be the optimal way to fix it, but UK productivity has flatlined since the global financial crisis. Investment as a percentage of GDP has consistently lagged the US and eurozone since the early 1990s.

Major political and economic obstacles make austerity-like policies unworkable. Governments are compelled to pursue active fiscal policies to address inequality, low productivity, and population ageing. The multi-polar world and climate change also require extra spending on defence and the transition to net zero. The upshot is big deficits could be with us for a while. Despite UK inflation trending lower, gilt yields have remained stubbornly high – a signal that investors are uneasy.

EM’s expected returns look good. The risk premia for asset classes like stocks, EM local-currency bonds, and Asia high-yield bonds are elevated because policy rates are expected to be a bit higher over the next decade. Good starting valuations mean that, over the long run, investors should be able to harvest income, or achieve capital gains.

In addition, EM currencies could boost potential returns further. The FX valuation model tracks the misalignment of current spot rates versus a fundamental valuation anchor. And it incorporates how macro fundamentals will evolve over the next decade to move FX equilibrium.

Geopolitical risks and a new multi-polar world mark a profound shift in the economic regime. But EM investors could benefit as macro trends in Asia and the Global South diverge from the West.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream, Data as at 7.30am UK time 25 October 2024.

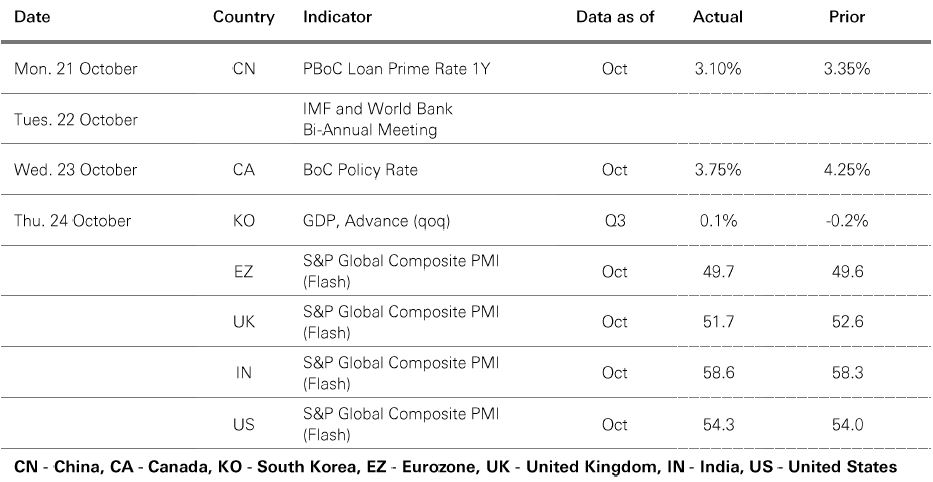

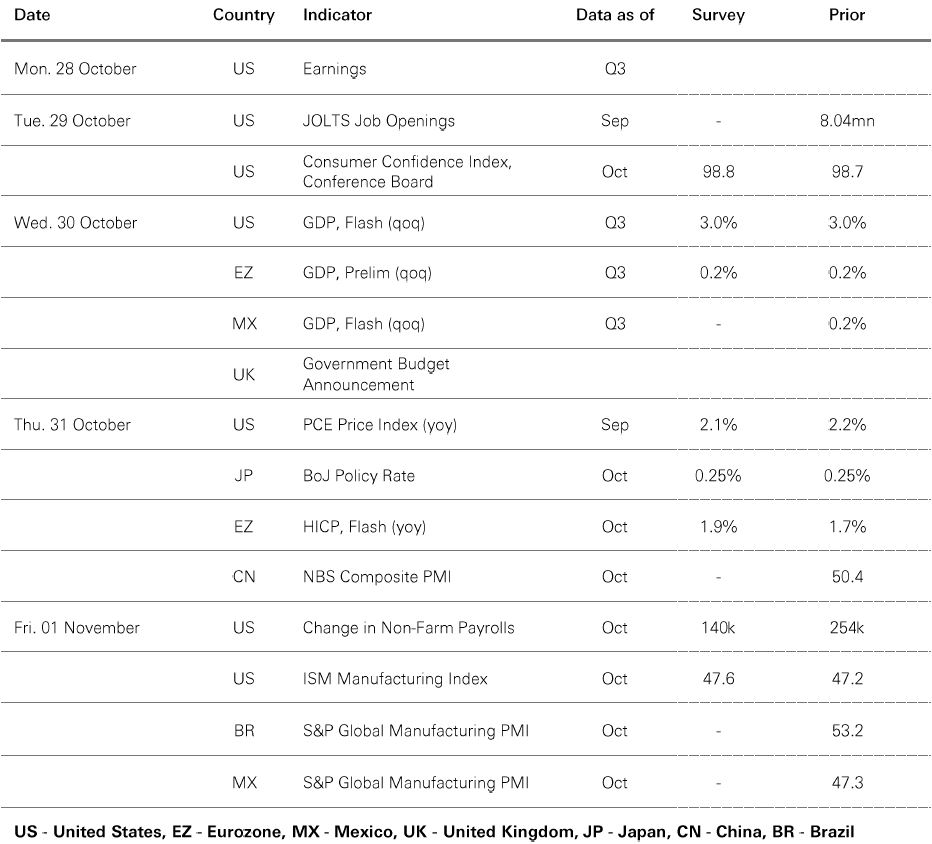

| Last week |

Source: HSBC Asset Management. Data as at 7.30am UK time 25 October 2024. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Global markets struck a cautious tone last week ahead of the looming US presidential election on 5 November, and key US payrolls data this week. 10-year US Treasury yields reached a three-month high of 4.26% before easing later last week, with the US dollar also rallying to a three-month high mid-week on uncertainty over the timetable for Fed rate cuts. In US stocks, both the large-cap S&P 500 and small-cap Russell 2000 declined early last week despite generally positive Q3 earnings news. The pan-European Stoxx Europe 600 fell, with Japan’s Nikkei 225 also seeing declines on political uncertainty ahead of the general election on 27 October. In emerging markets, China’s Shanghai Composite was a rare positive performer, but India’s Sensex and Korea’s Kospi indices both lost ground. In commodities, the oil price was broadly stable, and gold traded just short of record highs.

Related Insights

With the US elections less than a month away, the markets’ focus on polls will further...[14 Oct]

The Fed rate cut and its forecast of no recession support market sentiment. We now expect...[1 Oct]

Last quarter proved to be an eventful period for investors, as more central banks embarked...[5 Sep]

This document or video is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document or video is distributed and/or made available by HSBC Bank Canada (including one or more of its subsidiaries HSBC Investment Funds (Canada) Inc. (“HIFC”), HSBC Private Investment Counsel (Canada) Inc. (“HPIC”) and HSBC InvestDirect division of HSBC Securities (Canada) Inc. (“HIDC”)), HSBC Bank (China) Company Limited, HSBC Continental Europe, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank Middle East Limited (UAE), HSBC UK Bank Plc, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (20080100642 1 (807705-X)), HSBC Bank (Taiwan) Limited, HSBC Bank plc, Jersey Branch, HSBC Bank plc, Guernsey Branch, HSBC Bank plc in the Isle of Man, HSBC Continental Europe, Greece, The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank (Vietnam) Limited, PT Bank HSBC Indonesia (HBID), HSBC Bank (Uruguay) S.A. (HSBC Uruguay is authorised and oversought by Banco Central del Uruguay), HBAP Sri Lanka Branch, The Hongkong and Shanghai Banking Corporation Limited – Philippine Branch, and HSBC FinTech Services (Shanghai) Company Limited (collectively, the “Distributors”) to their respective clients. This document or video is for general circulation and information purposes only.

The contents of this document or video may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document or video must not be distributed in any jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document or video will be the responsibility of the user and may lead to legal proceedings. The material contained in this document or video is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document or video may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HBAP and the Distributors do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document or video has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed are based on the HSBC Global Investment Committee at the time of preparation, and are subject to change at any time. These views may not necessarily indicate HSBC Asset Management‘s current portfolios’ composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients’ objectives, risk preferences, time horizon, and market liquidity.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance contained in this document or video is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Investments are subject to market risks, read all investment related documents carefully.

This document or video provides a high level overview of the recent economic environment and has been prepared for information purposes only. The views presented are those of HBAP and are based on HBAP’s global views and may not necessarily align with the Distributors’ local views. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. It is not intended to provide and should not be relied on for accounting, legal or tax advice. Before you make any investment decision, you may wish to consult an independent financial adviser. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether the investment product is suitable for you. You are advised to obtain appropriate professional advice where necessary.

The accuracy and/or completeness of any third party information obtained from sources which we believe to be reliable might have not been independently verified, hence Customer must seek from several sources prior to making investment decision.

Important Information about HSBC Global Asset Management (Canada) Limited (“AMCA”)

HSBC Asset Management is a group of companies, including AMCA, that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings plc. AMCA is a wholly owned subsidiary of, but separate entity from, HSBC Bank Canada.

Important Information about HSBC Investment Funds (Canada) Inc. (“HIFC”)

HIFC is the principal distributor of the HSBC Mutual Funds and offers the HSBC Mutual Funds and/or the HSBC Pooled Funds through the HSBC World Selection® Portfolio service. HIFC is a subsidiary of AMCA, and indirect subsidiary of HSBC Bank Canada, and provides its products and services in all provinces of Canada except Prince Edward Island. Mutual fund investments are subject to risks. Please read the Fund Facts before investing.

®World Selection is a registered trademark of HSBC Group Management Services Limited.

Important Information about HSBC Private Investment Counsel (Canada) Inc. (“HPIC”)

HPIC is a direct subsidiary of HSBC Bank Canada and provides services in all provinces of Canada except Prince Edward Island. The Private Investment Counsel service is a discretionary portfolio management service offered by HPIC. Under this discretionary service, assets of participating clients will be invested by HPIC or its delegated portfolio manager, AMCA, in securities, including but not limited to, stocks, bonds, mutual funds, pooled funds and derivatives. The value of an investment in or purchased as part of the Private Investment Counsel service may change frequently and past performance may not be repeated.

Important Information about HSBC InvestDirect (“HIDC”)

HIDC is a division of HSBC Securities (Canada) Inc., a direct subsidiary of, but separate entity from, HSBC Bank Canada. HIDC is an order execution only service. HIDC will not conduct suitability assessments of client account holdings or of the orders submitted by clients or from anyone authorized to trade on the client’s behalf. Clients have the sole responsibility for their investment decisions and securities transactions.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada, Australia or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/ business. However, the Bank disclaims any guarantee on the management or operation performance of the trust business.

The following statement is only applicable to PT Bank HSBC Indonesia (“HBID”): PT Bank HSBC Indonesia (“HBID”) is licensed and supervised by Indonesia Financial Services Authority (“OJK”). Customer must understand that historical performance does not guarantee future performance. Investment product that are offered in HBID is third party products, HBID is a selling agent for third party product such as Mutual Fund and Bonds. HBID and HSBC Group (HSBC Holdings Plc and its subsidiaries and associates company or any of its branches) does not guarantee the underlying investment, principal or return on customer investment. Investment in Mutual Funds and Bonds is not covered by the deposit insurance program of the Indonesian Deposit Insurance Corporation (LPS).

THE CONTENTS OF THIS DOCUMENT OR VIDEO HAVE NOT BEEN REVIEWED BY ANY REGULATORY AUTHORITY IN HONG KONG OR ANY OTHER JURISDICTION.

YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THE INVESTMENT AND THIS DOCUMENT OR VIDEO. IF YOU ARE IN DOUBT ABOUT ANY OF THE CONTENTS OF THIS DOCUMENT OR VIDEO, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE.

© Copyright 2024. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document or video may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.

Important information on sustainable investing

“Sustainable investments” include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors (collectively, “sustainability”) to varying degrees. Certain instruments we include within this category may be in the process of changing to deliver sustainability outcomes.

There is no guarantee that sustainable investments will produce returns similar to those which don’t consider these factors. Sustainable investments may diverge from traditional market benchmarks.

In addition, there is no standard definition of, or measurement criteria for sustainable investments, or the impact of sustainable investments (“sustainability impact”). Sustainable investment and sustainability impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and/or reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of sustainability impact will be achieved.

Sustainable investing is an evolving area and new regulations may come into effect which may affect how an investment is categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.