7 October 2024

Recent stimulus announcements have sparked a dramatic recovery in China’s stock market – making it the top performing global market this year… and perhaps the strongest example yet of the great rotations we’ve seen in markets in 2024.

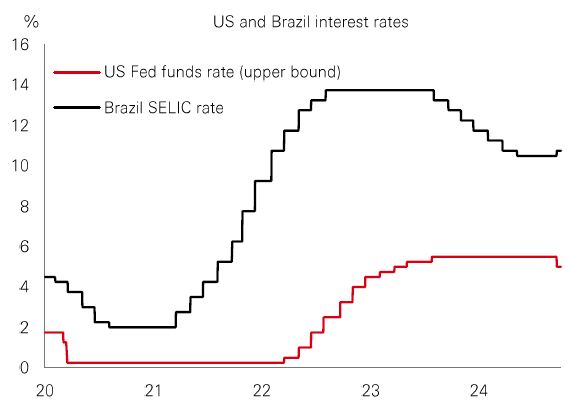

Back in March 2021, Banco Central do Brasil (BCB) became one of the first major central banks to start hiking rates in response to the pandemic surge in inflation. As a global leader in the policy cycle, could September’s BCB rate hike be a cautionary tale for the Fed, just as it kicks off its easing cycle?

European stocks outperformed their US peers in Q3, helped by the ‘broadening out’ trade and their strong exposure to China, with investors seeking value outside the US. However, there is an intriguing disconnect between country-level macro data and profit growth expectations.

There were some remarkable twists and turns in the macro and market environment in Q3, and one of the biggest was the recent Politburo-endorsed package of support in China. That sparked a stunning rally in the country’s stocks, which reversed China’s laggard status this year, and put the overall performance of emerging market stocks at +19% year-to-date, slightly ahead of developed markets.

Policy was a major focus during the quarter, with the Fed finally joining the global easing cycle with a 0.5% rate cut. The backdrop to that move is that the economy remains on course for a soft landing. Despite some bumps, inflation continued its retreat, but growth also cooled, with mixed employment data causing volatility at times, particularly in early August.

In markets, a ‘great rotation’ in leadership was a strong theme. In developed markets, the ‘Magnificent 7’ were robust – rising around 4%, but there were more signs of a broadening out of returns and profit growth expectations across sectors and markets. Japan, Europe, and UK indices largely outperformed the US. And in the US itself, the small-cap Russell 2000 beat the S&P 500. Meanwhile, emerging market regions accelerated on a weakening US dollar and anticipation of rate cuts, with Asian regions setting the pace (see Market Spotlight), but Latam markets continued to lag. Across other asset classes, high quality fixed income performed as the global easing cycle progressed.

Stocks in mainland China and Hong Kong set the pace in Q3 – with a remarkable rally late in the quarter delivering gains of 23% and 24% respectively for MSCI indices. But even before that, weakness in the US dollar as Fed policy easing got started (and rate expectations were repriced) sparked a pick-up in the performance of EM Asian markets. ASEAN was notable, with the region’s MSCI index up 19% in Q3. That was driven by a rebound in foreign inflows in response to the favourable FX environment, regional monetary easing, and a resilient macro backdrop. Thailand, the Philippines, and Malaysia led the gains. Year-to-date, China, India, and Asia (ex-Japan) now lead global performance.

EM Asian credits were also strong during the quarter, with Asia high yield a leading performer globally. In part, that was driven by well-performing names in markets like India and Indonesia. And from here, some specialists believe the default outlook is favourable with good funding access, strong balance sheets and a resilient macro backdrop for a vast majority of Asian companies.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets.

This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11.00am UK time 07 October 2024.

Recent stimulus announcements have sparked a dramatic recovery in China’s stock market – making it the top-performing global market this year… and perhaps the strongest example yet of the great rotations we’ve seen in markets in 2024.

The gains are impressive. But the starting point was one of serial underperformance, connected to concerns about nominal growth. On valuation measures like ‘earnings yield’, there had been a large ‘China discount’, which gave stocks room to move sharply on better-than-expected news. It meant the stimulus was ‘doubly good’ for the market because investor sentiment had been so bad.

After a rally of historic proportions, some short-term caution is probably warranted. But the comprehensive liquidity measures mean that the ‘policy put’ is back. Further fiscal and credit stimulus will be crucial to make the market recovery sustainable, but China’s policy stimulus, combined with Fed jumbo cuts, improves the odds that the global economy will stick to a soft landing.

Back in March 2021, Banco Central do Brasil (BCB) became one of the first major central banks to start hiking rates in response to the pandemic surge in inflation. As a global leader in the policy cycle, could September’s BCB rate hike be a cautionary tale for the Fed, just as it kicks off its easing cycle?

Brazil’s recent switch to policy tightening came a year after the country’s leadership launched a public spending spree that fuelled domestic demand. Tight labour markets, a pick-up in wage growth, and a weaker Brazilian real have since proved inflationary.

For some onlookers, there are similar risks lurking in the US. November’s US presidential election could result in a sizeable fiscal boost and shift tariff rates higher, while the US dollar remains on a weakening trend.

The comparison is off the mark. The fiscal boost wouldn’t come until 2026, and the labour market and wider economy is cooling. But the potential shift in policies could mean a higher-than-expected endpoint for rates in this policy easing cycle, with consequences for longer-term investors.

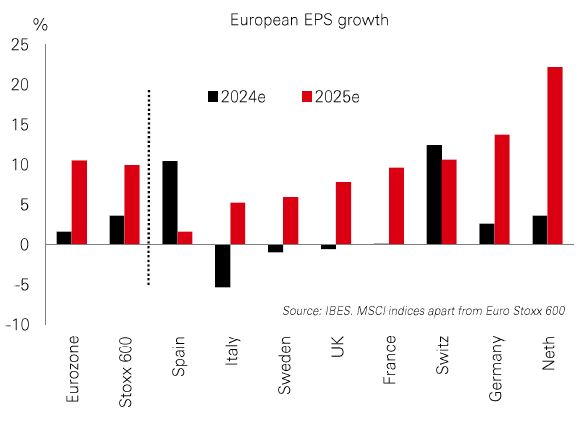

European stocks outperformed their US peers in Q3, helped by the ‘broadening out’ trade and their strong exposure to China, with investors seeking value outside the US. However, there is an intriguing disconnect between country-level macro data and profit growth expectations.

On the macro front, Europe is expected to grow in 2025, but recent activity data for Germany and France has been weak, with manufacturing PMIs well below 50. Germany’s auto sector is struggling in particular. By contrast, the same industrial confidence surveys in Spain have been more positive. Meanwhile, the big drivers of wider European profit growth – which is expected to jump from 2-3% this year to around 10% in 2025e – are pencilled in as Germany and France. Both are forecast to move from low single digits in 2024e to 10-13% next year. But Spanish EPS growth is set to fall.

This apparent contradiction in the macro outlook and expected earnings growth implies scope for surprises.

Past performance does not predict future returns. This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice. Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream. Data as at 11.00am UK time 07 October 2024.

| Last week |

Source: HSBC Asset Management. Data as at 11.00am UK time 07 October 2024. This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice.

Heightened geopolitical concerns weighed on risk markets, with oil prices climbing on rising supply worries. The US dollar DXY index was little changed. Core government bonds were mixed, with US Treasuries weakening on comments by Fed Chair Powell that there was no urgency to ease policy. Bunds rallied on dovish ECB comments. Global equities softened, with US stocks falling across the board, and the small-cap Russell 2000 faring worst. The Euro Stoxx 50 fell on growing concerns about the eurozone’s economic outlook, while Japan’s Nikkei 225 was little changed despite a weaker yen following comments by new LDP president Ishiba on monetary policy. In emerging markets, the Hang Seng rallied further, Korea’s tech-driven Kospi index weakened, and India’s Sensex index also lost ground in a holiday-shortened week. Copper and gold both consolidated following recent rallies.

Related Insights

Last quarter proved to be an eventful period for investors, as more central banks embarked...[5 Sep]

US recession fears have eased on solid earnings growth along with more constructive labour...[2 Sep]

As expected, the FOMC kept rates unchanged at the July meeting. The Fed funds rate remains...[1 Aug]

This document or video is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document or video is distributed and/or made available by HSBC Bank Canada (including one or more of its subsidiaries HSBC Investment Funds (Canada) Inc. (“HIFC”), HSBC Private Investment Counsel (Canada) Inc. (“HPIC”) and HSBC InvestDirect division of HSBC Securities (Canada) Inc. (“HIDC”)), HSBC Bank (China) Company Limited, HSBC Continental Europe, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank Middle East Limited (UAE), HSBC UK Bank Plc, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (20080100642 1 (807705-X)), HSBC Bank (Taiwan) Limited, HSBC Bank plc, Jersey Branch, HSBC Bank plc, Guernsey Branch, HSBC Bank plc in the Isle of Man, HSBC Continental Europe, Greece, The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank (Vietnam) Limited, PT Bank HSBC Indonesia (HBID), HSBC Bank (Uruguay) S.A. (HSBC Uruguay is authorised and oversought by Banco Central del Uruguay), HBAP Sri Lanka Branch, The Hongkong and Shanghai Banking Corporation Limited – Philippine Branch, and HSBC FinTech Services (Shanghai) Company Limited (collectively, the “Distributors”) to their respective clients. This document or video is for general circulation and information purposes only.

The contents of this document or video may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document or video must not be distributed in any jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document or video will be the responsibility of the user and may lead to legal proceedings. The material contained in this document or video is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document or video may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HBAP and the Distributors do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document or video has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed are based on the HSBC Global Investment Committee at the time of preparation, and are subject to change at any time. These views may not necessarily indicate HSBC Asset Management‘s current portfolios’ composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients’ objectives, risk preferences, time horizon, and market liquidity.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance contained in this document or video is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Investments are subject to market risks, read all investment related documents carefully.

This document or video provides a high level overview of the recent economic environment and has been prepared for information purposes only. The views presented are those of HBAP and are based on HBAP’s global views and may not necessarily align with the Distributors’ local views. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. It is not intended to provide and should not be relied on for accounting, legal or tax advice. Before you make any investment decision, you may wish to consult an independent financial adviser. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether the investment product is suitable for you. You are advised to obtain appropriate professional advice where necessary.

The accuracy and/or completeness of any third party information obtained from sources which we believe to be reliable might have not been independently verified, hence Customer must seek from several sources prior to making investment decision.

Important Information about HSBC Global Asset Management (Canada) Limited (“AMCA”)

HSBC Asset Management is a group of companies, including AMCA, that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings plc. AMCA is a wholly owned subsidiary of, but separate entity from, HSBC Bank Canada.

Important Information about HSBC Investment Funds (Canada) Inc. (“HIFC”)

HIFC is the principal distributor of the HSBC Mutual Funds and offers the HSBC Mutual Funds and/or the HSBC Pooled Funds through the HSBC World Selection® Portfolio service. HIFC is a subsidiary of AMCA, and indirect subsidiary of HSBC Bank Canada, and provides its products and services in all provinces of Canada except Prince Edward Island. Mutual fund investments are subject to risks. Please read the Fund Facts before investing.

®World Selection is a registered trademark of HSBC Group Management Services Limited.

Important Information about HSBC Private Investment Counsel (Canada) Inc. (“HPIC”)

HPIC is a direct subsidiary of HSBC Bank Canada and provides services in all provinces of Canada except Prince Edward Island. The Private Investment Counsel service is a discretionary portfolio management service offered by HPIC. Under this discretionary service, assets of participating clients will be invested by HPIC or its delegated portfolio manager, AMCA, in securities, including but not limited to, stocks, bonds, mutual funds, pooled funds and derivatives. The value of an investment in or purchased as part of the Private Investment Counsel service may change frequently and past performance may not be repeated.

Important Information about HSBC InvestDirect (“HIDC”)

HIDC is a division of HSBC Securities (Canada) Inc., a direct subsidiary of, but separate entity from, HSBC Bank Canada. HIDC is an order execution only service. HIDC will not conduct suitability assessments of client account holdings or of the orders submitted by clients or from anyone authorized to trade on the client’s behalf. Clients have the sole responsibility for their investment decisions and securities transactions.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada, Australia or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/ business. However, the Bank disclaims any guarantee on the management or operation performance of the trust business.

The following statement is only applicable to PT Bank HSBC Indonesia (“HBID”): PT Bank HSBC Indonesia (“HBID”) is licensed and supervised by Indonesia Financial Services Authority (“OJK”). Customer must understand that historical performance does not guarantee future performance. Investment product that are offered in HBID is third party products, HBID is a selling agent for third party product such as Mutual Fund and Bonds. HBID and HSBC Group (HSBC Holdings Plc and its subsidiaries and associates company or any of its branches) does not guarantee the underlying investment, principal or return on customer investment. Investment in Mutual Funds and Bonds is not covered by the deposit insurance program of the Indonesian Deposit Insurance Corporation (LPS).

THE CONTENTS OF THIS DOCUMENT OR VIDEO HAVE NOT BEEN REVIEWED BY ANY REGULATORY AUTHORITY IN HONG KONG OR ANY OTHER JURISDICTION.

YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THE INVESTMENT AND THIS DOCUMENT OR VIDEO. IF YOU ARE IN DOUBT ABOUT ANY OF THE CONTENTS OF THIS DOCUMENT OR VIDEO, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE.

© Copyright 2024. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document or video may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.

Important information on sustainable investing

“Sustainable investments” include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors (collectively, “sustainability”) to varying degrees. Certain instruments we include within this category may be in the process of changing to deliver sustainability outcomes.

There is no guarantee that sustainable investments will produce returns similar to those which don’t consider these factors. Sustainable investments may diverge from traditional market benchmarks.

In addition, there is no standard definition of, or measurement criteria for sustainable investments, or the impact of sustainable investments (“sustainability impact”). Sustainable investment and sustainability impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and/or reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of sustainability impact will be achieved.

Sustainable investing is an evolving area and new regulations may come into effect which may affect how an investment is categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.