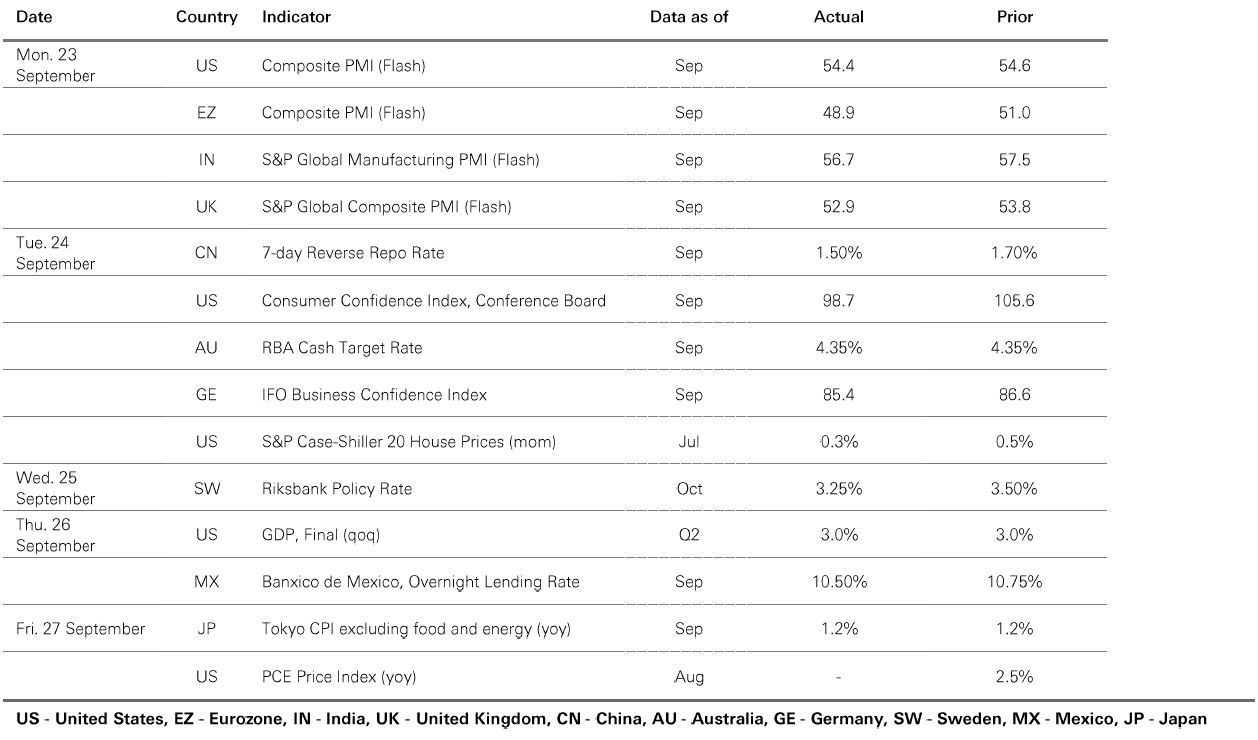

30 September 2024

China’s new package of economic stimulus helped drive European stock markets higher last week.

A quick glance at the returns of major credit markets this year, shows Asian high yield as a standout performer. But tactically, some caution is warranted following the blistering run and macro and geopolitical risks.

Yields on 10-year French bonds rose above their Spanish equivalents last week for the first time since 2007.

Chinese policymakers have unveiled a raft of new measures aimed at reviving the stock market, together with an easing of monetary policy and more efforts to stabilise the property sector. The move is a co-ordinated policy push to boost economic confidence and asset markets.

For markets, new measures include facilities to give eligible financial institutions liquidity to buy stocks, support share buybacks, and help major shareholders raise holdings. A national stabilisation fund is also under consideration. The securities regulator also issued guidelines to promote M&A and restructuring to help boost the value of listed firms.

On monetary policy, the 7-day reverse repo rate was cut by -0.20% to 1.5%, and the reserve requirement ratio for large banks was lowered, boosting liquidity. For the property sector, supportive measures include lower rates for existing mortgages, a lower downpayment ratio for second homes, and more funding for the property destocking scheme.

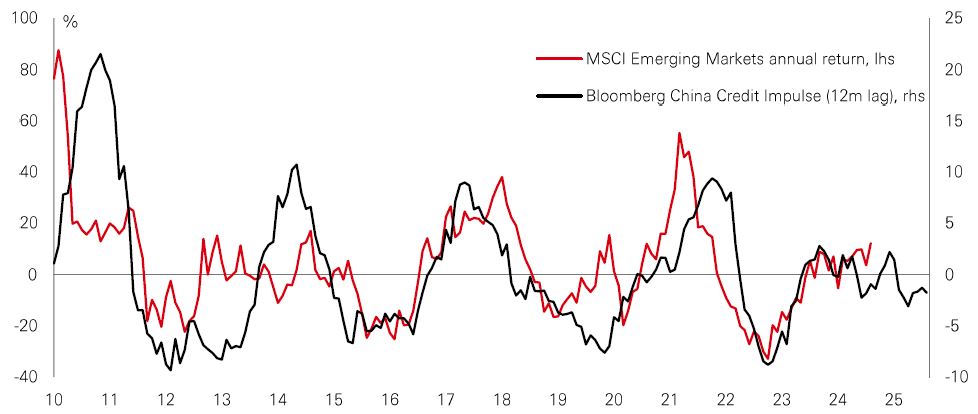

The moves follow the previous week’s US rate cut, which eased pressure on the yuan and gave China’s central bank room to cut rates as it seeks to reflate the economy. The near-term effect on stocks is clearly positive – with China’s Shanghai Composite index rising nearly 13% last week, and EM markets enjoying a broad pick-up in sentiment (see chart). Chinese leaders have also vowed to intensify fiscal support, and further improve the focus and effectiveness of policy measures. This is welcome, given that a sustainable recovery in Chinese stocks is likely to hinge on clear signs of macro reflation and a corporate earnings recovery.

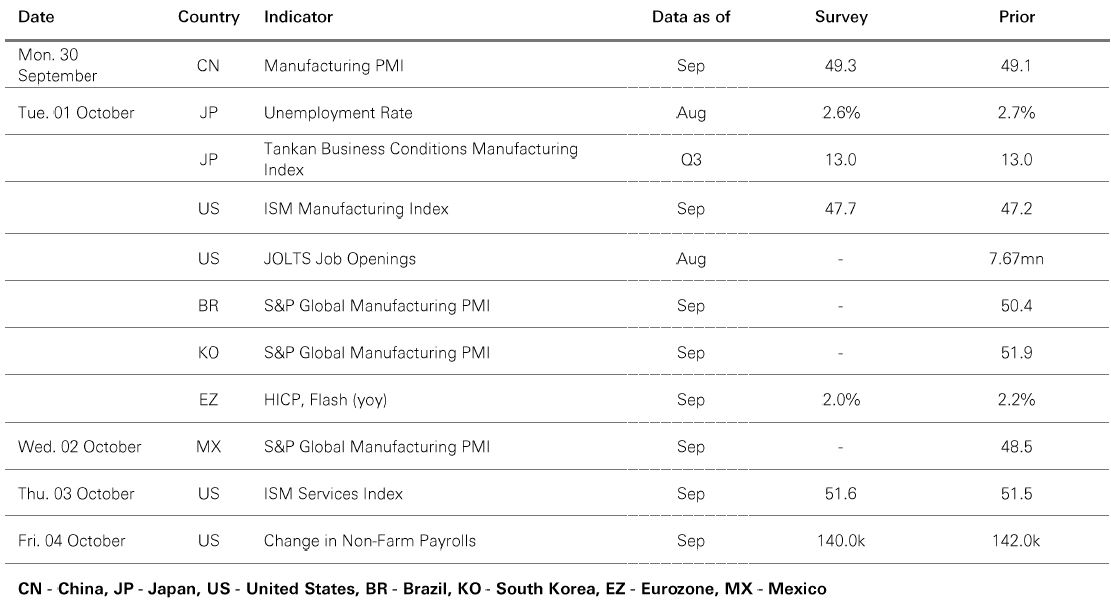

Investment markets are ‘hyper-sensitive’ to macro news. But with inflation in retreat, and faster labour market cooling now the top risk for investors, the source of hyper-sensitivity has shifted. It’s the jobs data that move markets now.

A new report by researchers at the Bank for International Settlements documents this idea well. The authors find that market hyper-sensitivity has become more acute in recent years because of an increasingly data dependent US Fed, which has focused on the next few months rather than longer run policy anchors.

This has fostered a ‘data point dependency’ in investment markets. This summer’s bouts of volatility caused by surprises in non-farm payroll data and core CPI inflation were good examples. It showed how short-term data can be noisy, and why it’s not healthy when the data cycle controls market trends.

It means the surprisingly-low stock market volatility seen earlier this year is unlikely to return. Hyper-sensitive markets, the risk of faster growth cooling, election uncertainty, geopolitical tensions, plus an interest rate market already expecting the Fed funds rate to be 3% by next summer, all point to a more volatile environment in Q4.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11.00am UK time 27 September 2024.

China’s new package of economic stimulus helped drive European stock markets higher last week. European firms have relatively high exposure to China, so new policy support and robust signalling of more measures to come have been welcomed. It’s particularly good news for countries like Germany, which continues to labour under an industrial downturn.

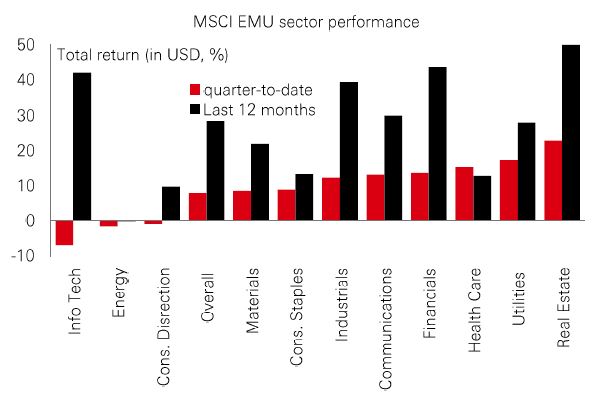

Market gains have come amid a broadening out of performance across sectors in Q3. The bloc’s relatively modest exposure to the technology sector compared to the US has played in its favour. And despite some weakness in recent macro and company news, investors have remained risk-on. Expectations of a soft landing have been particularly helpful to left behind, rate-sensitive sectors, with real estate, healthcare, and utilities in top spot during the quarter.

European stocks currently trade on a 5% discount to their long run average 12-month forward price-earnings ratio of 13x. Earnings have lagged but are expected to rise to 10.2% in 2025. That could present selective value opportunities, but earnings could also be sensitive to a more pronounced global slowdown – so some caution is warranted.

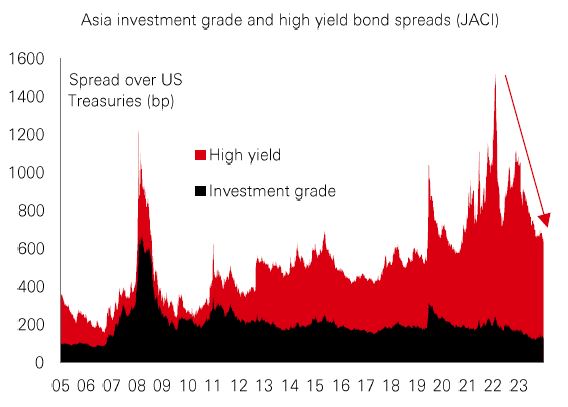

A quick glance at the returns of major credit markets this year shows Asian high yield as a standout performer. Spreads – as measured by the benchmark JP Morgan Asia Credit Index (JACI) – have collapsed, continuing the strong recovery from late 2022’s yield spike as a number of China’s beleaguered property developers defaulted.

Last week’s China stimulus package is good news for the asset class. Not only does it boost cyclically sensitive names in the region but also helps provide a floor for China’s property names – the most volatile part of the universe. And with this sector now a much smaller component of the overall index, default rates should continue to moderate. Exposure to non-China names is also increasing, including in growth superstars such as India and ASEAN economies. The trend of increasing country and sector diversification implies significantly less volatility over time.

Spreads remain high versus their 10-year historical range, implying room for further gains. But tactically, some caution is warranted following the blistering run and macro and geopolitical risks.

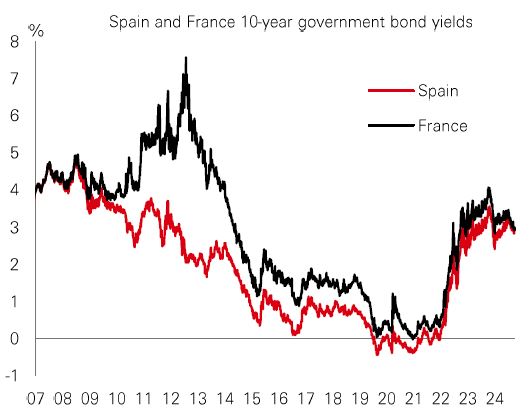

Yields on 10-year French bonds rose above their Spanish equivalents last week for the first time since 2007. The yield gap between the two has tightened in recent months, after trading as wide as 0.45% earlier in 2024.

Eurozone peripheral country bonds, including Spain’s, have been in particular demand since the ECB began cutting rates in June. Investors have been attracted by their relatively high yields, as well as positive signs of fiscal consolidation and improving debt ratios. Italy, Portugal, and Greece have also captured attention. By comparison, there has been growing unease over France’s deteriorating public finances and political uncertainty, which has put pressure on its bond spreads.

Recent market pricing offers evidence of a blurring of lines between the eurozone’s traditional core bond markets (Germany and France) and its riskier periphery.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice. Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream. Data as at 11.00am UK time 27 September 2024.

| Last week |

Source: HSBC Asset Management. Data as at 11.00am UK time 27 September 2024. This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way.

Risk assets rallied on details of a comprehensive stimulus package to support the Chinese economy, with China’s Politburo pledging further fiscal action to come. Core government bonds softened with Treasuries underperforming Bunds ahead of key US employment data. Global equities were broadly positive, led by a rally across emerging markets. China’s Shanghai Composite and Hong Kong’s Hang Seng indices surged, with Chinese stocks enjoying their strongest week since 2008. Korea’s Kospi and India’s Sensex posted modest gains. In developed markets, the Euro Stoxx 600 touched new highs, outperforming the S&P 500, with China-exposed luxury goods stocks recording notable gains. Japan’s Nikkei 225 also performed well, supported by a weaker yen. In commodities, oil prices retreated on rising supply worries. Copper and gold were both on course to close the week higher.

Related Insights

Last quarter proved to be an eventful period for investors, as more central banks embarked...[5 Sep]

US recession fears have eased on solid earnings growth along with more constructive labour...[2 Sep]

As expected, the FOMC kept rates unchanged at the July meeting. The Fed funds rate remains...[1 Aug]

This document or video is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document or video is distributed and/or made available by HSBC Bank Canada (including one or more of its subsidiaries HSBC Investment Funds (Canada) Inc. (“HIFC”), HSBC Private Investment Counsel (Canada) Inc. (“HPIC”) and HSBC InvestDirect division of HSBC Securities (Canada) Inc. (“HIDC”)), HSBC Bank (China) Company Limited, HSBC Continental Europe, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank Middle East Limited (UAE), HSBC UK Bank Plc, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (20080100642 1 (807705-X)), HSBC Bank (Taiwan) Limited, HSBC Bank plc, Jersey Branch, HSBC Bank plc, Guernsey Branch, HSBC Bank plc in the Isle of Man, HSBC Continental Europe, Greece, The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank (Vietnam) Limited, PT Bank HSBC Indonesia (HBID), HSBC Bank (Uruguay) S.A. (HSBC Uruguay is authorised and oversought by Banco Central del Uruguay), HBAP Sri Lanka Branch, The Hongkong and Shanghai Banking Corporation Limited – Philippine Branch, and HSBC FinTech Services (Shanghai) Company Limited (collectively, the “Distributors”) to their respective clients. This document or video is for general circulation and information purposes only.

The contents of this document or video may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document or video must not be distributed in any jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document or video will be the responsibility of the user and may lead to legal proceedings. The material contained in this document or video is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document or video may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HBAP and the Distributors do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document or video has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed are based on the HSBC Global Investment Committee at the time of preparation, and are subject to change at any time. These views may not necessarily indicate HSBC Asset Management‘s current portfolios’ composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients’ objectives, risk preferences, time horizon, and market liquidity.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance contained in this document or video is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Investments are subject to market risks, read all investment related documents carefully.

This document or video provides a high level overview of the recent economic environment and has been prepared for information purposes only. The views presented are those of HBAP and are based on HBAP’s global views and may not necessarily align with the Distributors’ local views. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. It is not intended to provide and should not be relied on for accounting, legal or tax advice. Before you make any investment decision, you may wish to consult an independent financial adviser. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether the investment product is suitable for you. You are advised to obtain appropriate professional advice where necessary.

The accuracy and/or completeness of any third party information obtained from sources which we believe to be reliable might have not been independently verified, hence Customer must seek from several sources prior to making investment decision.

Important Information about HSBC Global Asset Management (Canada) Limited (“AMCA”)

HSBC Asset Management is a group of companies, including AMCA, that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings plc. AMCA is a wholly owned subsidiary of, but separate entity from, HSBC Bank Canada.

Important Information about HSBC Investment Funds (Canada) Inc. (“HIFC”)

HIFC is the principal distributor of the HSBC Mutual Funds and offers the HSBC Mutual Funds and/or the HSBC Pooled Funds through the HSBC World Selection® Portfolio service. HIFC is a subsidiary of AMCA, and indirect subsidiary of HSBC Bank Canada, and provides its products and services in all provinces of Canada except Prince Edward Island. Mutual fund investments are subject to risks. Please read the Fund Facts before investing.

®World Selection is a registered trademark of HSBC Group Management Services Limited.

Important Information about HSBC Private Investment Counsel (Canada) Inc. (“HPIC”)

HPIC is a direct subsidiary of HSBC Bank Canada and provides services in all provinces of Canada except Prince Edward Island. The Private Investment Counsel service is a discretionary portfolio management service offered by HPIC. Under this discretionary service, assets of participating clients will be invested by HPIC or its delegated portfolio manager, AMCA, in securities, including but not limited to, stocks, bonds, mutual funds, pooled funds and derivatives. The value of an investment in or purchased as part of the Private Investment Counsel service may change frequently and past performance may not be repeated.

Important Information about HSBC InvestDirect (“HIDC”)

HIDC is a division of HSBC Securities (Canada) Inc., a direct subsidiary of, but separate entity from, HSBC Bank Canada. HIDC is an order execution only service. HIDC will not conduct suitability assessments of client account holdings or of the orders submitted by clients or from anyone authorized to trade on the client’s behalf. Clients have the sole responsibility for their investment decisions and securities transactions.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada, Australia or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/ business. However, the Bank disclaims any guarantee on the management or operation performance of the trust business.

The following statement is only applicable to PT Bank HSBC Indonesia (“HBID”): PT Bank HSBC Indonesia (“HBID”) is licensed and supervised by Indonesia Financial Services Authority (“OJK”). Customer must understand that historical performance does not guarantee future performance. Investment product that are offered in HBID is third party products, HBID is a selling agent for third party product such as Mutual Fund and Bonds. HBID and HSBC Group (HSBC Holdings Plc and its subsidiaries and associates company or any of its branches) does not guarantee the underlying investment, principal or return on customer investment. Investment in Mutual Funds and Bonds is not covered by the deposit insurance program of the Indonesian Deposit Insurance Corporation (LPS).

THE CONTENTS OF THIS DOCUMENT OR VIDEO HAVE NOT BEEN REVIEWED BY ANY REGULATORY AUTHORITY IN HONG KONG OR ANY OTHER JURISDICTION.

YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THE INVESTMENT AND THIS DOCUMENT OR VIDEO. IF YOU ARE IN DOUBT ABOUT ANY OF THE CONTENTS OF THIS DOCUMENT OR VIDEO, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE.

© Copyright 2024. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document or video may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.

Important information on sustainable investing

“Sustainable investments” include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors (collectively, “sustainability”) to varying degrees. Certain instruments we include within this category may be in the process of changing to deliver sustainability outcomes.

There is no guarantee that sustainable investments will produce returns similar to those which don’t consider these factors. Sustainable investments may diverge from traditional market benchmarks.

In addition, there is no standard definition of, or measurement criteria for sustainable investments, or the impact of sustainable investments (“sustainability impact”). Sustainable investment and sustainability impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and/or reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of sustainability impact will be achieved.

Sustainable investing is an evolving area and new regulations may come into effect which may affect how an investment is categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.