17 June 2024

Indian stocks broke to new highs last week, quickly recovering from fleeting election-driven volatility. Key to the rebound has been anticipation of policy continuity under the BJP-led NDA coalition.

European market volatility picked up last week after French President Emmanuel Macron called a snap legislative vote in the aftermath of the European Parliament election results.

As the eurozone exits from last year’s mild recession and the ECB eases policy, there are significant implications for the outlook for European earnings growth.

US Treasuries have been knocked about by macro waves of late, with the past week no exception. The 10-year UST yield jumped c.20bp on bumper payrolls the previous Friday. Then the release of May’s inflation data last week – which came in softer-than-expected – helped pull yields back down, hitting a two-and-a-half month low. Nevertheless, investor expectations on Fed easing this year continue to flit between one or two rate cuts. This is roughly in line with the latest FOMC view, although a minority of members expect no cuts at all in 2024.

What it the latest data telling us? Payrolls likely overstate the strength of the labour market. A wider selection of indicators shows that while the labour market is not yet cool, it is cooling. Fed Chair Powell views the market as back to where it was before the pandemic: “tight but not overheated”. Equally, while May’s core CPI print overstates the pace of underlying improvement, it does at least demonstrate that although inflation has been sticky, it is not completely stuck.

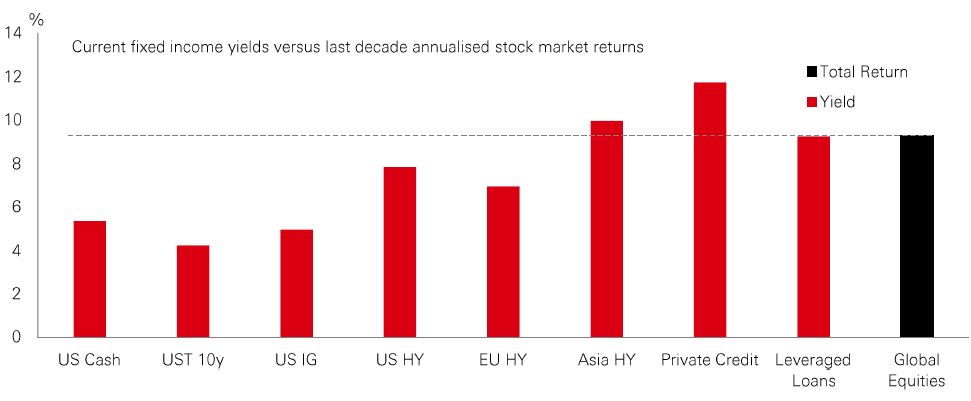

Although risk assets have been the place to be over the past 18 months, bond yields are high, with the potential for capital gains if the trend of gradual economic cooling and disinflation continues – and the Fed starts cutting rates.

Chinese stocks continue to perform relatively well, outpacing both developed and emerging markets during the second quarter. The rebound has been aided by better-than-expected macro data in Q1, especially around exports and accelerating manufacturing and infrastructure investment. Supportive policy, especially for the property sector, resilient earnings and better shareholder returns have also boosted sentiment.

A mix of undemanding equity valuations and an uptick in momentum has led to a pick-up in investor interest. Decade-low foreign allocations to China have shown signs of unwinding, with a closing of underweight gaps compared to levels seen at the start of the year.

An ailing property sector and flagging consumption remain the weak economic links. But with pragmatic policy that keeps up the recovery, international demand could continue to grow.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11am UK time 14 June 2024.

Indian stocks broke to new highs last week, quickly recovering from fleeting election-driven volatility. Key to the rebound has been anticipation of policy continuity under the BJP-led NDA coalition.

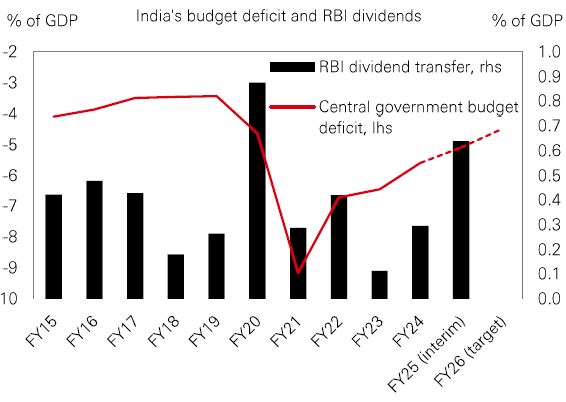

On the fiscal front, the new government has the advantage of a higher-than-budgeted dividend transfer from the Reserve Bank of India (RBI) and robust tax revenue growth. At 2.1 trillion-rupees (USD25 billion), the RBI’s recent payout was twice what was forecast. And that should give the country’s leaders more scope to cut the budget deficit and stick to a roadmap of fiscal consolidation.

For now, a little-changed macro trajectory should be supportive for Indian bonds. It comes just as they are about to get greater international exposure when they join JPMorgan’s EM government bond index later in June. For equities, attention already appears to be shifting back to medium-term fundamentals, with Indian stocks expected to deliver mid-teens earnings growth this year.

European market volatility picked up last week after French President Emmanuel Macron called a snap legislative vote in the aftermath of the European Parliament election results.

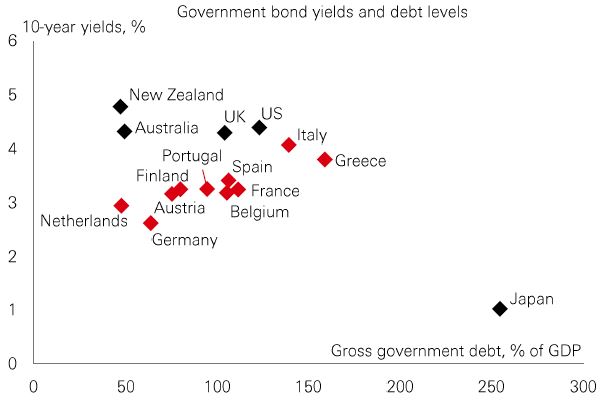

Higher political and economic uncertainty for France comes at a time when underlying fiscal measures have been deteriorating. S&P downgraded France’s sovereign rating from AA to AA- last month. The French government upgraded its 2023 budget deficit/GDP ratio to 5.5%, putting France on the EU’s Excessive Deficit Procedure List. The spread between French and German government bond yields has risen to levels last seen in 2017.

At a time when national debt levels in most Western economies have been rising, and defects are wide, governments will need to tread carefully to avoid the wrath of the bond market vigilantes. A backdrop of fiscal activism makes this all the more tricky. Positively for Europe, however, disinflation is progressing and the ECB has already cut rates, easing some of the pressure. And higher yields are a key reason why investors can put cash to work in fixed income.

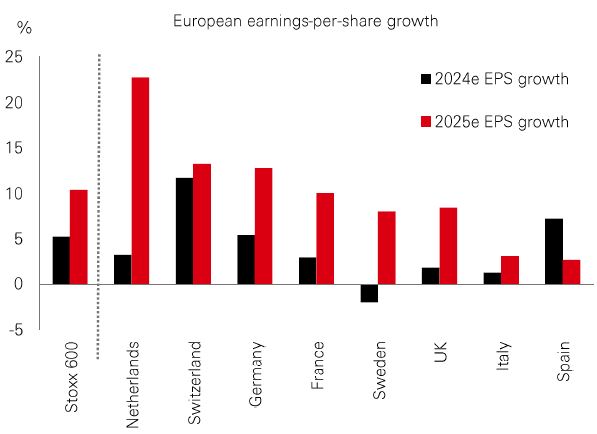

As the eurozone exits from last year’s mild recession and the ECB eases policy, there are significant implications for the outlook for European earnings growth.

In 2024, EPS growth has been fairly concentrated in markets such as Spain and Switzerland, which are relatively defensive. But for 2025, not only is EPS growth expected to double to 10% as the recovery takes hold, there should also be a broadening out of growth to more cyclically-exposed markets, especially in the north.

Next year’s earnings outperformers – markets such as Germany, France, and Sweden – also benefit from low valuations, and currently trade below their 10-year average 12m-forward price-earnings ratios. And any euro weakness should benefit the region’s exporters – with 52% of Stoxx 600 revenues generated outside of Europe. But while the economic growth trajectory looks set to improve, the outlook still depends on future Fed policy and continuing economic momentum in the US.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11am UK time 14 June 2024.

| Last week |

Source: HSBC Asset Management. Data as at 11am UK time 14 June 2024.

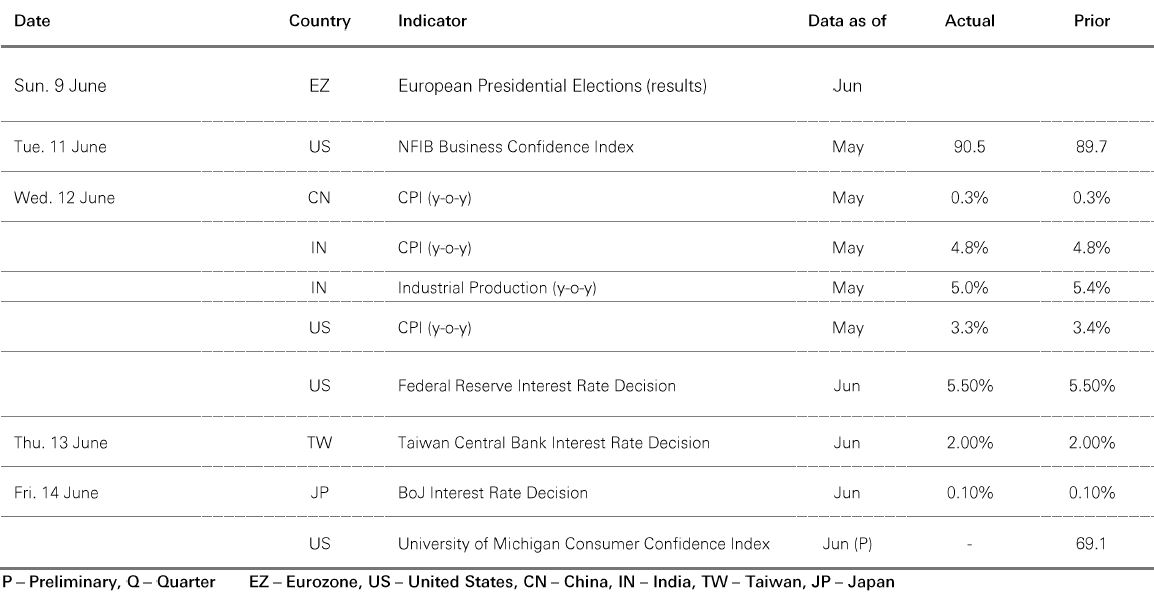

Benign US CPI data boosted risk markets last week. Core government bonds rallied as investors digested comments from Fed Chair Powell. The median Fed member expects one rate cut in 2024, down from three cuts in March. There were diverging trends between US and European equities: the S&P 500 rose to a record high, powered by the Magnificent 7 technology stocks, but rising political uncertainty weighed on the Euro Stoxx 50. Japan’s Nikkei 225 was little changed as the BoJ left policy on hold. In EM, the Shanghai Composite weakened amid lingering deflation concerns, while India’s Sensex consolidated after rebounding from recent volatility. Markets in Taiwan and Korea traded higher on positive read-across from the US tech sector. In commodities, energy prices recovered on a solid demand outlook, with oil on course for its best week in two months. Gold priced also edged higher.

Related Insights

For its seventh consecutive meeting, the FOMC voted unanimously to leave the benchmark...[13 Jun]

April’s improved US inflation data and a less hawkish Fed tone suggest that a Fed rate cut...[1 Jun]

Market expectations for Fed rate cuts have been on a roller-coaster ride, swinging from too...[23 May]

This document or video is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document or video is distributed and/or made available by HSBC Bank Canada (including one or more of its subsidiaries HSBC Investment Funds (Canada) Inc. (“HIFC”), HSBC Private Investment Counsel (Canada) Inc. (“HPIC”) and HSBC InvestDirect division of HSBC Securities (Canada) Inc. (“HIDC”)), HSBC Bank (China) Company Limited, HSBC Continental Europe, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank Middle East Limited (UAE), HSBC UK Bank Plc, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (20080100642 1 (807705-X)), HSBC Bank (Taiwan) Limited, HSBC Bank plc, Jersey Branch, HSBC Bank plc, Guernsey Branch, HSBC Bank plc in the Isle of Man, HSBC Continental Europe, Greece, The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank (Vietnam) Limited, PT Bank HSBC Indonesia (HBID), HSBC Bank (Uruguay) S.A. (HSBC Uruguay is authorised and oversought by Banco Central del Uruguay), HBAP Sri Lanka Branch, The Hongkong and Shanghai Banking Corporation Limited – Philippine Branch, and HSBC FinTech Services (Shanghai) Company Limited (collectively, the “Distributors”) to their respective clients. This document or video is for general circulation and information purposes only.

The contents of this document or video may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document or video must not be distributed in any jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document or video will be the responsibility of the user and may lead to legal proceedings. The material contained in this document or video is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document or video may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HBAP and the Distributors do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document or video has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed are based on the HSBC Global Investment Committee at the time of preparation, and are subject to change at any time. These views may not necessarily indicate HSBC Asset Management‘s current portfolios’ composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients’ objectives, risk preferences, time horizon, and market liquidity.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance contained in this document or video is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Investments are subject to market risks, read all investment related documents carefully.

This document or video provides a high level overview of the recent economic environment and has been prepared for information purposes only. The views presented are those of HBAP and are based on HBAP’s global views and may not necessarily align with the Distributors’ local views. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. It is not intended to provide and should not be relied on for accounting, legal or tax advice. Before you make any investment decision, you may wish to consult an independent financial adviser. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether the investment product is suitable for you. You are advised to obtain appropriate professional advice where necessary.

The accuracy and/or completeness of any third party information obtained from sources which we believe to be reliable might have not been independently verified, hence Customer must seek from several sources prior to making investment decision.

Important Information about HSBC Global Asset Management (Canada) Limited (“AMCA”)

HSBC Asset Management is a group of companies, including AMCA, that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings plc. AMCA is a wholly owned subsidiary of, but separate entity from, HSBC Bank Canada.

Important Information about HSBC Investment Funds (Canada) Inc. (“HIFC”)

HIFC is the principal distributor of the HSBC Mutual Funds and offers the HSBC Mutual Funds and/or the HSBC Pooled Funds through the HSBC World Selection® Portfolio service. HIFC is a subsidiary of AMCA, and indirect subsidiary of HSBC Bank Canada, and provides its products and services in all provinces of Canada except Prince Edward Island. Mutual fund investments are subject to risks. Please read the Fund Facts before investing.

®World Selection is a registered trademark of HSBC Group Management Services Limited.

Important Information about HSBC Private Investment Counsel (Canada) Inc. (“HPIC”)

HPIC is a direct subsidiary of HSBC Bank Canada and provides services in all provinces of Canada except Prince Edward Island. The Private Investment Counsel service is a discretionary portfolio management service offered by HPIC. Under this discretionary service, assets of participating clients will be invested by HPIC or its delegated portfolio manager, AMCA, in securities, including but not limited to, stocks, bonds, mutual funds, pooled funds and derivatives. The value of an investment in or purchased as part of the Private Investment Counsel service may change frequently and past performance may not be repeated.

Important Information about HSBC InvestDirect (“HIDC”)

HIDC is a division of HSBC Securities (Canada) Inc., a direct subsidiary of, but separate entity from, HSBC Bank Canada. HIDC is an order execution only service. HIDC will not conduct suitability assessments of client account holdings or of the orders submitted by clients or from anyone authorized to trade on the client’s behalf. Clients have the sole responsibility for their investment decisions and securities transactions.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada, Australia or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/ business. However, the Bank disclaims any guarantee on the management or operation performance of the trust business.

The following statement is only applicable to PT Bank HSBC Indonesia (“HBID”): PT Bank HSBC Indonesia (“HBID”) is licensed and supervised by Indonesia Financial Services Authority (“OJK”). Customer must understand that historical performance does not guarantee future performance. Investment product that are offered in HBID is third party products, HBID is a selling agent for third party product such as Mutual Fund and Bonds. HBID and HSBC Group (HSBC Holdings Plc and its subsidiaries and associates company or any of its branches) does not guarantee the underlying investment, principal or return on customer investment. Investment in Mutual Funds and Bonds is not covered by the deposit insurance program of the Indonesian Deposit Insurance Corporation (LPS).

THE CONTENTS OF THIS DOCUMENT OR VIDEO HAVE NOT BEEN REVIEWED BY ANY REGULATORY AUTHORITY IN HONG KONG OR ANY OTHER JURISDICTION.

YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THE INVESTMENT AND THIS DOCUMENT OR VIDEO. IF YOU ARE IN DOUBT ABOUT ANY OF THE CONTENTS OF THIS DOCUMENT OR VIDEO, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE.

© Copyright 2024. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document or video may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.

Important information on sustainable investing

“Sustainable investments” include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors (collectively, “sustainability”) to varying degrees. Certain instruments we include within this category may be in the process of changing to deliver sustainability outcomes.

There is no guarantee that sustainable investments will produce returns similar to those which don’t consider these factors. Sustainable investments may diverge from traditional market benchmarks.

In addition, there is no standard definition of, or measurement criteria for sustainable investments, or the impact of sustainable investments (“sustainability impact”). Sustainable investment and sustainability impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and/or reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of sustainability impact will be achieved.

Sustainable investing is an evolving area and new regulations may come into effect which may affect how an investment is categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.