6 August 2024

US stocks fell further and the Treasury yield curve flattened.

European stocks and government bonds fell.

Asian stocks plunged amid a global selloff.

US equities extended last week’s losses to close sharply lower on Monday amid investor concerns about the US economy, though stocks pared some of earlier losses after an upside surprise in ISM services data. The S&P 500 was down 3.0%.

US Treasuries reversed earlier gains to end with a flatter yield curve, after the ISM services data release helped calm the risk-off sentment. 2-year yields rose 4bp to 3.92%, 10-year yields were flat at 3.79%, while 30-year yields fell 4bp to 4.07%.

European stock markets declined on Monday following a selloff in global stocks. The Euro Stoxx 50 fell 1.4%. The German DAX fell 1.8% and the French CAC fell 1.4%. In the UK, the FTSE-100 dropped 2.0%.

European government bonds initially rallied amid a flight to safe havens, but pared gains after better-than-expected US ISM services data. 10-year German yields ended 2bp higher at 2.19% with 10-year French yields up 1bp to 2.98%. In the UK, 10-year gilt yields rose 4bp to 3.87%.

Asia stock markets plunged on Monday amid rising fears of a deeper US economic slowdown, and a risk-off sentiment also drove an intensified sell-off in tech shares in the region. Japan’s Nikkei 225 tumbled 12.4% as the Japanese yen rallied further and the JGB yields slid markedly. Korea’s Kospi also sank 8.8%, led by chipmakers. Chinese equities showed milder losses, with Hong Kong’s Hang Seng and China’s Shanghai Composite both losing 1.5%. Elsewhere, India’s Sensex ended 2.7% lower.

Crude oil prices fell on Monday amid global risk selloff, while investors continued to assess geopolitical developments. WTI crude for September delivery settled 0.8% lower at USD72.9 a barrel.

The US ISM Services Index rose to 51.4 in July, from 48.8 in June, supporting the case for an economic correction rather than a collapse.

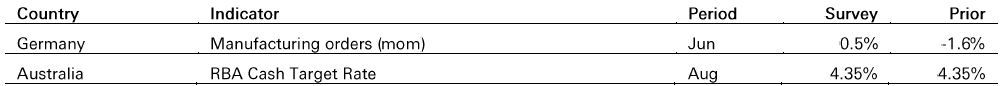

In Germany, manufacturing orders are expected to increase by 0.5% mom in June, after a -1.6% mom drop in May, but likely remained weak and suggested production is likely to struggle in coming months.

The Reserve Bank of Australia (RBA) is forecast to leave the interest rate on hold at 4.35% as core inflation, while trending down, remains too high for the RBA’s comfort.

Related Insights

As expected, the FOMC kept rates unchanged at the July meeting. The Fed funds rate remains...[1 Aug]

Despite media headlines about the US election, investors should focus on earnings, rates...[1 Aug]

As of 9 July, President Joe Biden's approval rating is 35.7%, while 53.4% of Americans...[12 Jul]

Market expectations for Fed rate cuts have been on a roller-coaster ride, swinging from too...[23 May]

This document has been issued by HSBC Bank (Taiwan) Limited (“the Bank”) in the conduct of its regulated business in Taiwan and may be distributed in other jurisdictions where its distribution is lawful. The content is for your reference only. The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document must not be distributed to any other jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings.

This document has no contractual value and is not and should not be construed as an offer or the solicitation of an offer or a recommendation for the purchase or sale of any investment in any jurisdiction in which such an offer is not lawful or subscribe for, or to participate in, any services. The Bank is not recommending or soliciting any action based on it.

The information stated and/or opinion(s) expressed in this document are provided by HSBC Global Asset Management Limited. We do not undertake any obligation to issue any further publications to you or update the contents of this document and such contents are subject to changes at any time without notice. They are expressed solely as general market information and/or commentary for general information purposes only and do not constitute investment advice or recommendation to buy or sell investments or guarantee of returns. The Bank has not been involved in the preparation of such information and opinion. The Bank makes no guarantee, representation or warranty and accepts no responsibility for the accuracy and/or completeness of the information and/or opinions contained in this document, including any third party information obtained from sources it believes to be reliable but which has not been independently verified. In no event will the Bank or HSBC Group be liable for any damages, losses or liabilities including without limitation, direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your use of this document or your reliance on or use or inability to use the information contained in this document.

In case you have individual portfolios managed by HSBC Global Asset Management Limited, the views expressed in this document may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Global Asset Management Limited primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity.

The Bank and HSBC Group and/or their officers, directors and employees may have positions in any securities or financial instruments mentioned in this document (or in any related investments) (if any) and may from time to time add to or dispose of any such securities or financial instruments or investments. The Bank and its affiliates may act as market maker or have assumed an underwriting commitment in the securities or financial instruments discussed in this document (or in related investments) (if any), may sell them to or buy them from customers on a principal basis and may also perform or seek to perform investment banking or underwriting services for or relating to those companies.

The information contained within this document has not been reviewed in the light of your personal circumstances. Please note that this information is neither intended to aid in decision making for legal, financial or other consulting questions, nor should it be the basis of any investment or other decisions. You should carefully consider whether any investment views and investment products are appropriate in view of your investment experience, objectives, financial resources and relevant circumstances. The investment decision is yours but you should not invest in any product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. The relevant product offering documents should be read for further details.

Some of the statements contained in this document may be considered forward-looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Such statements do not represent any one investment and are used for illustration purpose only. Customers are reminded that there can be no assurance that economic conditions described herein will remain in the future. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We can give no assurance that those expectations reflected in those forward-looking statements will prove to have been correct or come to fruition, and you are cautioned not to place undue reliance on such statements. We do not undertake any obligation to update the forward-looking statements contained herein, whether as a result of new information, future events or otherwise, or to update the reasons why actual results could differ from those projected in the forward-looking statements.

Investment involves risk. It is important to note that the capital value of investments and the income from them may go down as well as up and may become valueless and investors may not get back the amount originally invested. Past performance contained in this document is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Past performance information may be out of date. For up-to-date information, please contact your Relationship Manager.

Investment in any market may be extremely volatile and subject to sudden fluctuations of varying magnitude due to a wide range of direct and indirect influences. Such characteristics can lead to considerable losses being incurred by those exposed to such markets. If an investment is withdrawn or terminated early, it may not return the full amount invested. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavourable fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political instability in certain jurisdictions. Narrowly focused investments and smaller companies typically exhibit higher volatility. There is no guarantee of positive trading performance. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Mutual fund investments are subject to market risks. You should read all scheme related documents carefully. The relevant investment risks of mutual fund investments are disclosed in fund prospectuses for your perusal. The past performance of fund manager should not be construed as the guarantee of any fund’s minimum return or similar performance in the future. Prospective investors shall seek independent opinions on individual investment programs for their particular interests and needs or on relevant factors. Investors shall make their own judgment in investments, and shall assume full responsibility on any gain/loss, or any direct or indirect loss deriving from the information provided.

The Bank shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/ conducting ordinary care in offering trust services/ business.

However, the Bank disclaims any guaranty on the management or operation performance of the trust business.