The launch of our HSBC Credit Card App

With the new HSBC Credit Card App, managing your credit cards has never been easier. Access a range of features at your fingertips, including transaction history, reward points management, instalment options, temporary credit limit adjustments, statement delivery preferences. You can also pay your credit card bills anytime, anywhere. This all-in-one platform is designed to provide you with the ultimate credit card experience.

New user guide

New to HSBC Credit Card App(HSBC Card+)? Please refer to our instructions

Services and features

Introduce a range of features of HSBC Credit Card App

FAQ

Please refer to the frequently asked questions for HSBC Credit Card App

New user guide

How to access HSBC Credit Card App(HSBC Card+)?

Three steps to check if you can register

Step 1: Become a card holder of a credit card issued by HSBC.

Step 2: Activate your credit card

Step 3: After finishing the previous two steps, you can now register for HSBC Credit Card App

Download HSBC Credit Card App(HSBC Card+)

*Download HSBC Credit Card App(Version 1.2.0 for iOS and version 1.2.0 for Android)

*For security reason, please do not use the Apple iPhone device has been jailbroken or Android device has been rooted or with USB debugging mode opening.

*You can download HSBC Credit Card App from App Store or Google Play in several countries excluding Mainland China, for example, The U.K., The U.S., Malaysia, and Singapore. Please search: HSBC Credit Card.Please scan the QR Code below with your mobile phone or click here to download

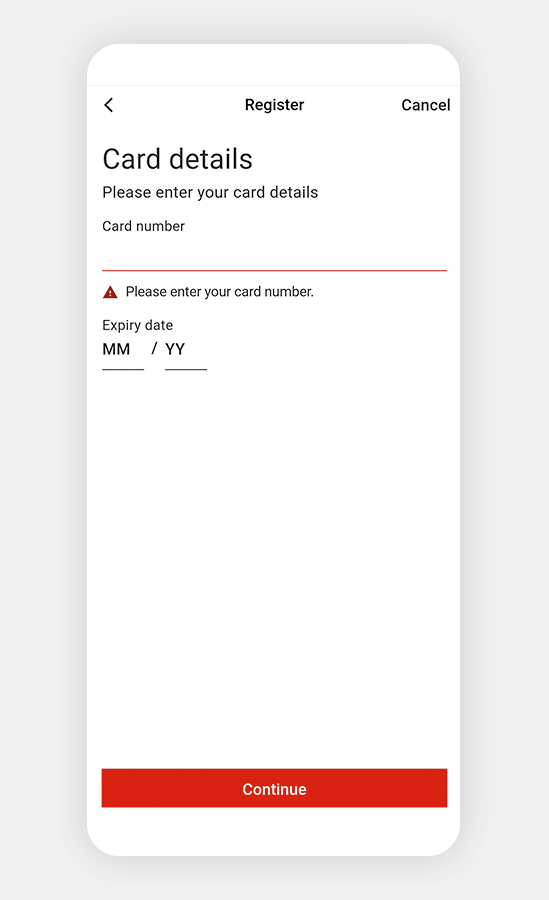

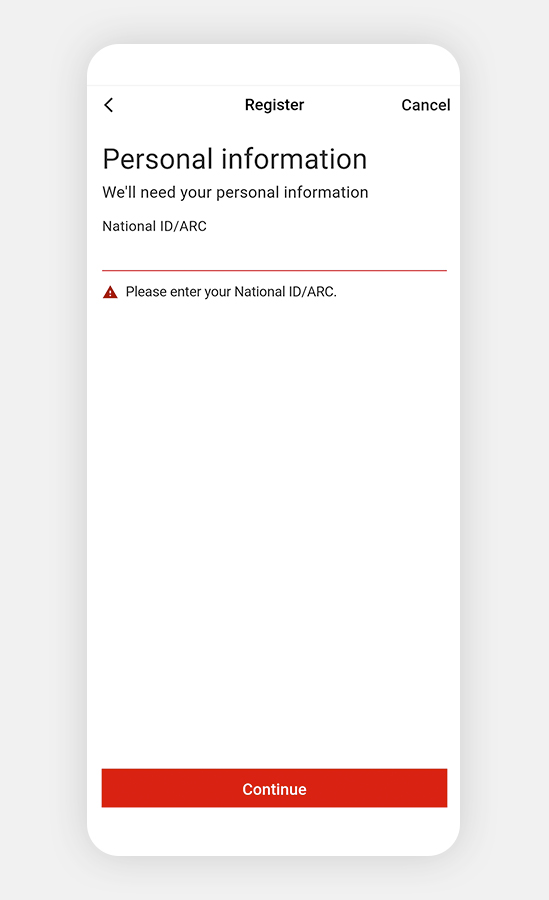

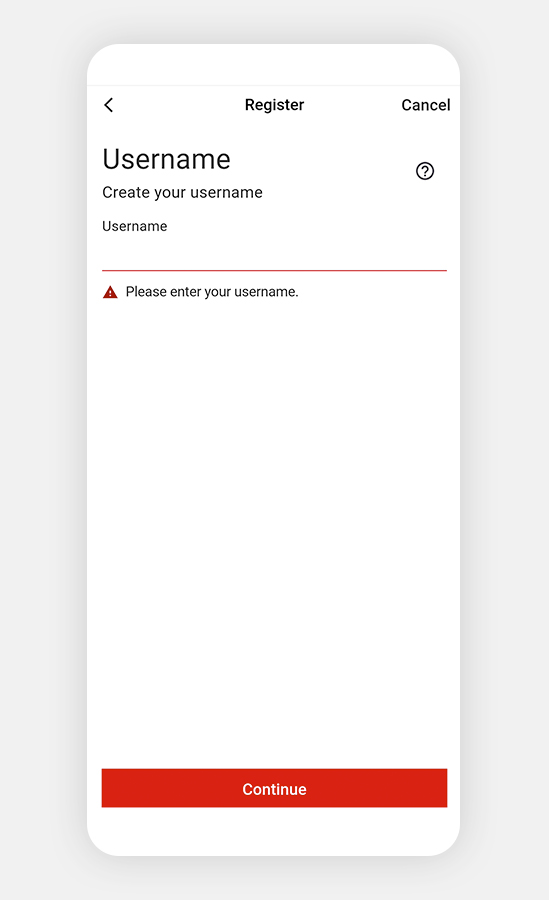

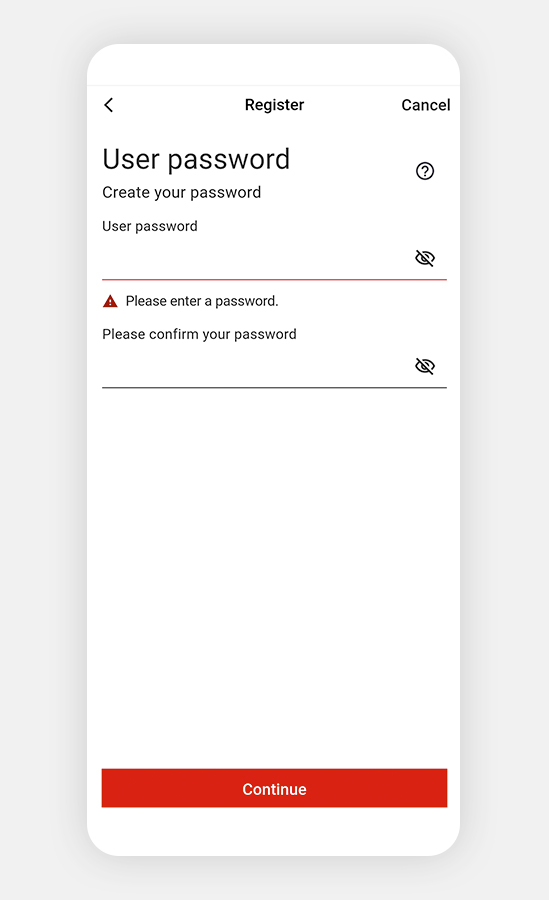

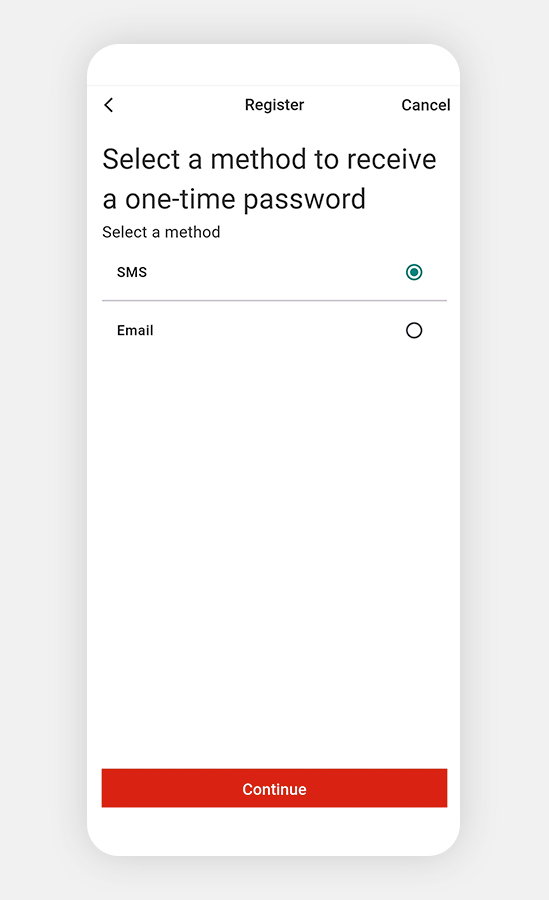

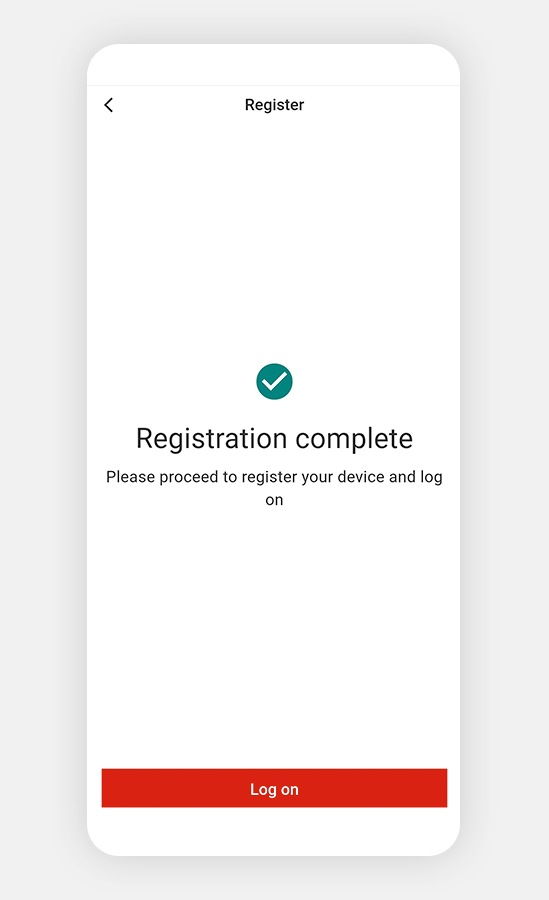

HSBC Credit Card App(HSBC Card+) Registration Tutorial

If you have already registered for HSBC(TW) Credit Card Internet Service, please directly download Credit Card App and log in with your username and password of Credit Card Internet Service.

If you haven't registered for HSBC(TW) Credit Card Internet Service, please download Credit Card App and refer to the following registration steps to complete the registration journey.

Please note that the username and password for HSBC(TW) Credit Card Internet Service and Credit Card App are the same.

Services and features

Functions and Features of HSBC Credit Card App(HSBC Card+)

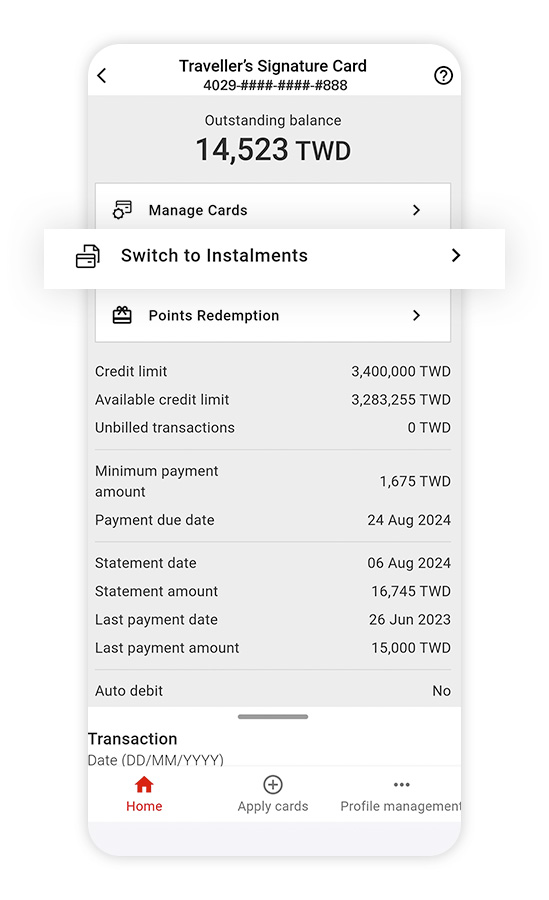

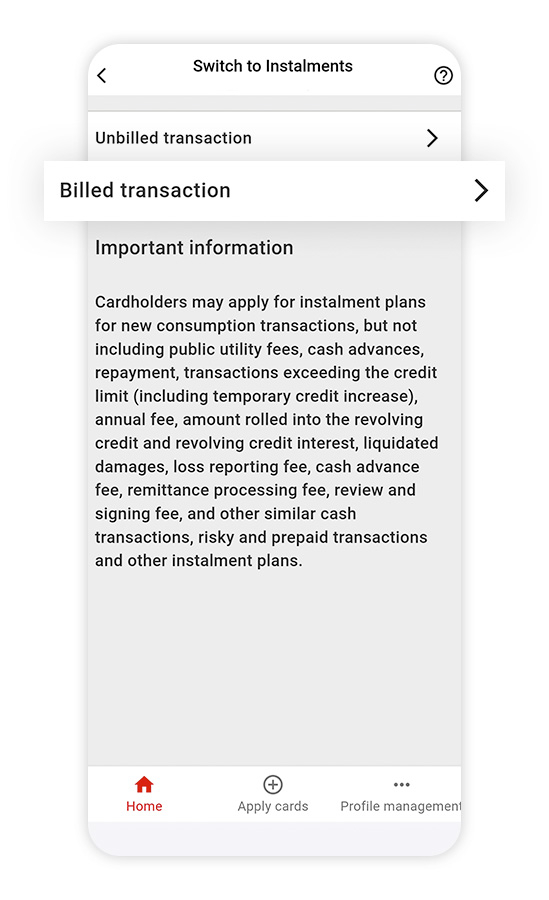

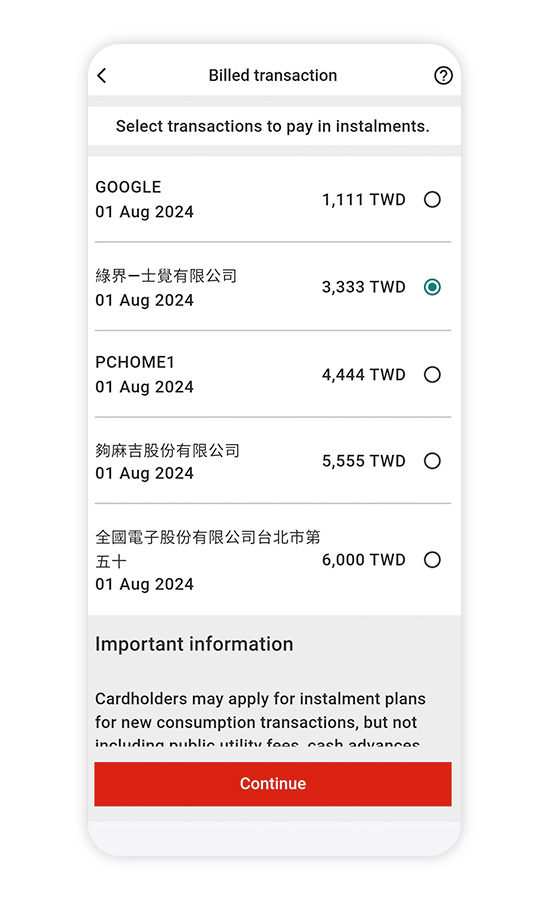

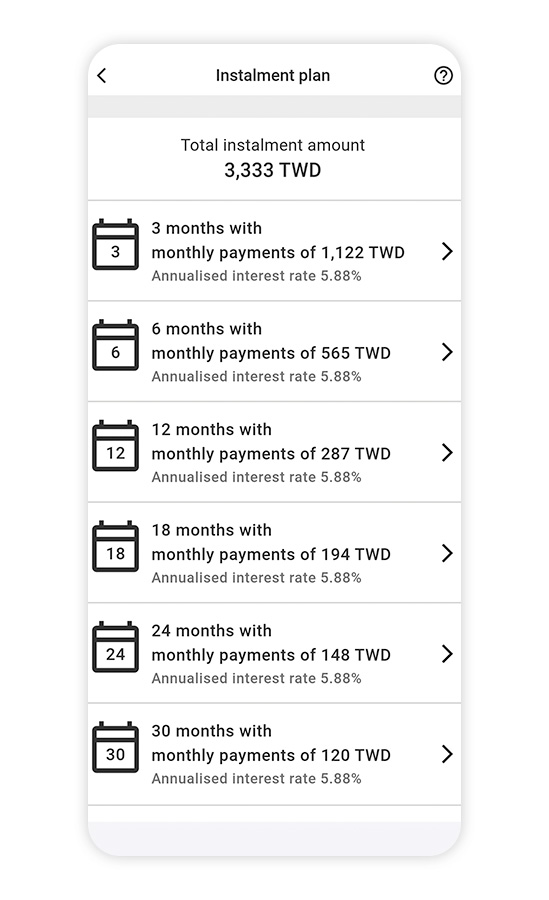

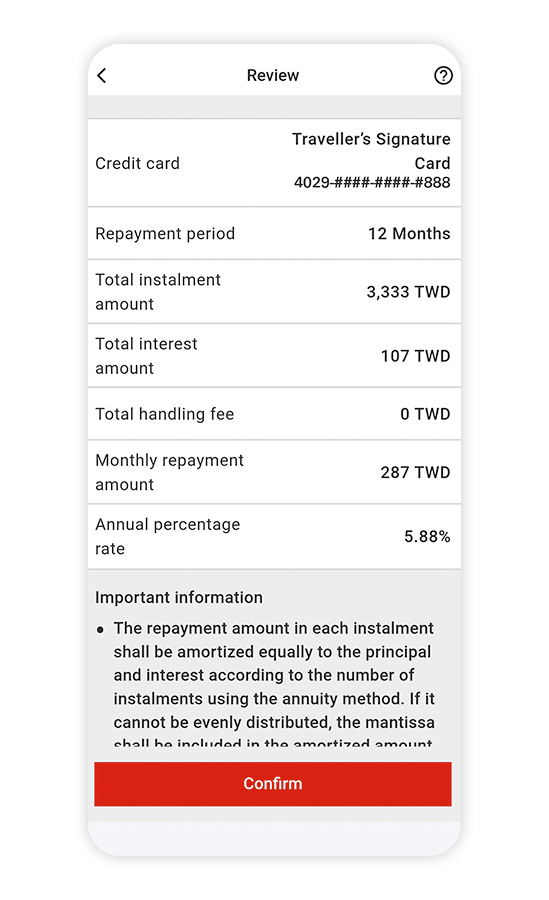

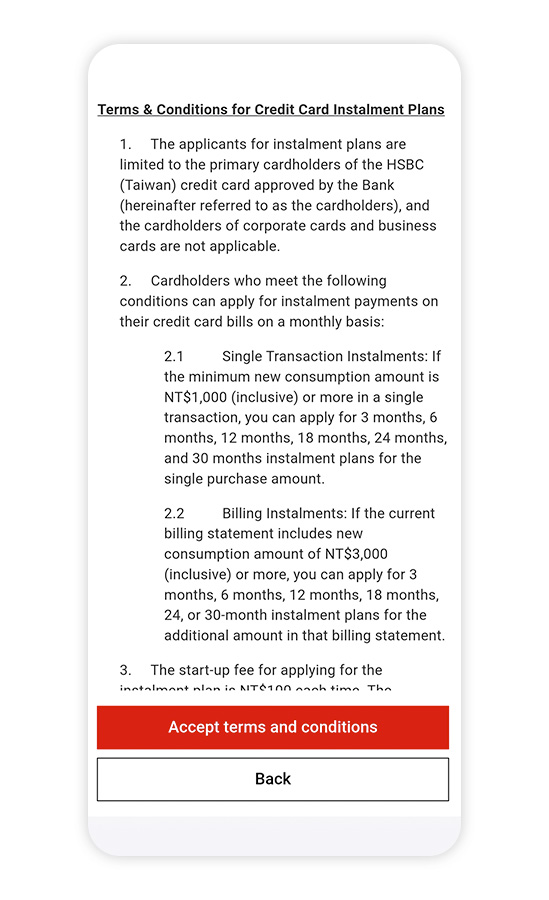

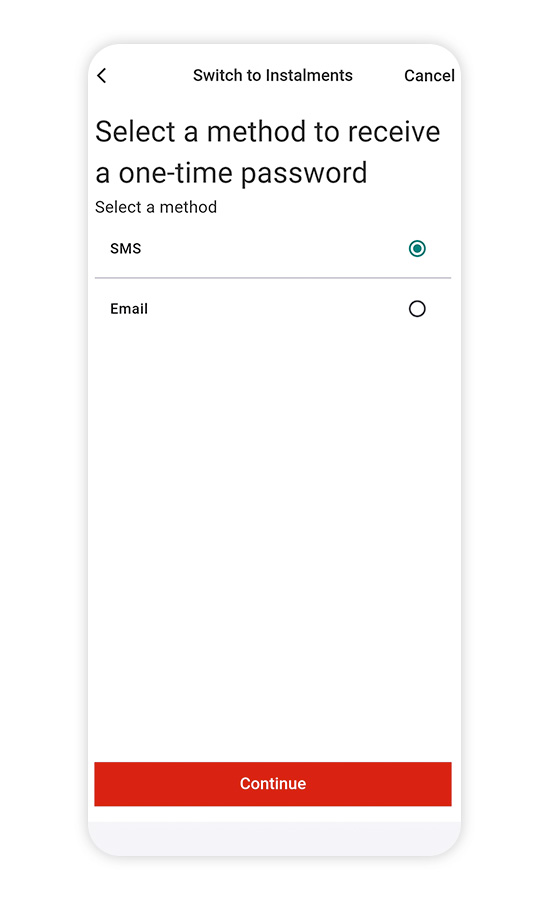

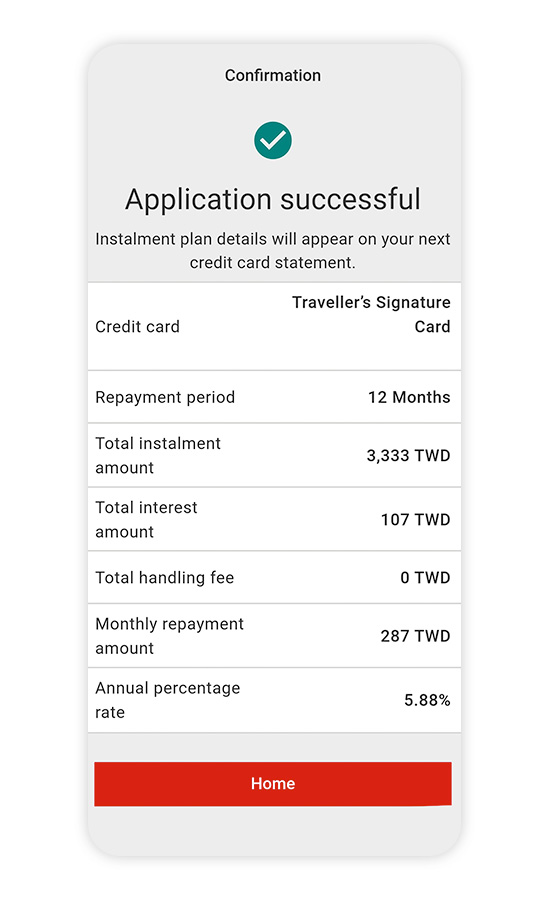

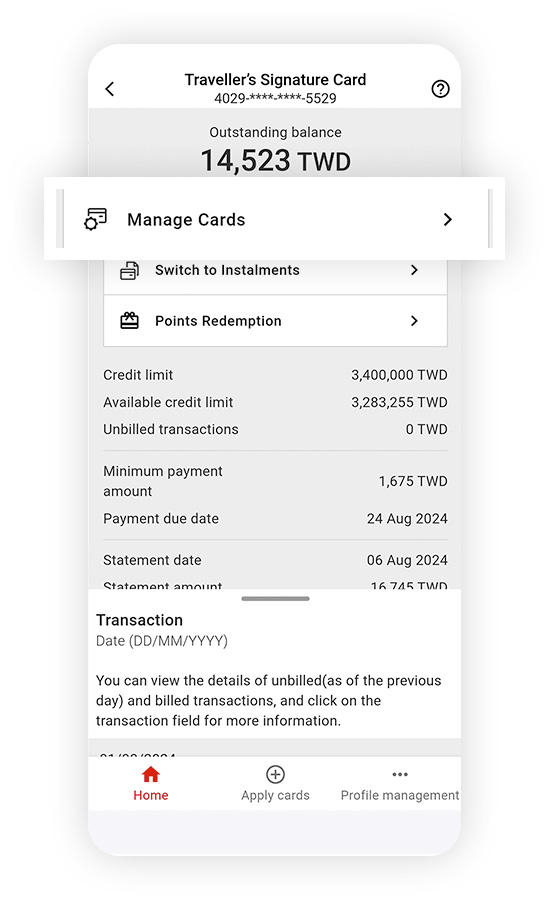

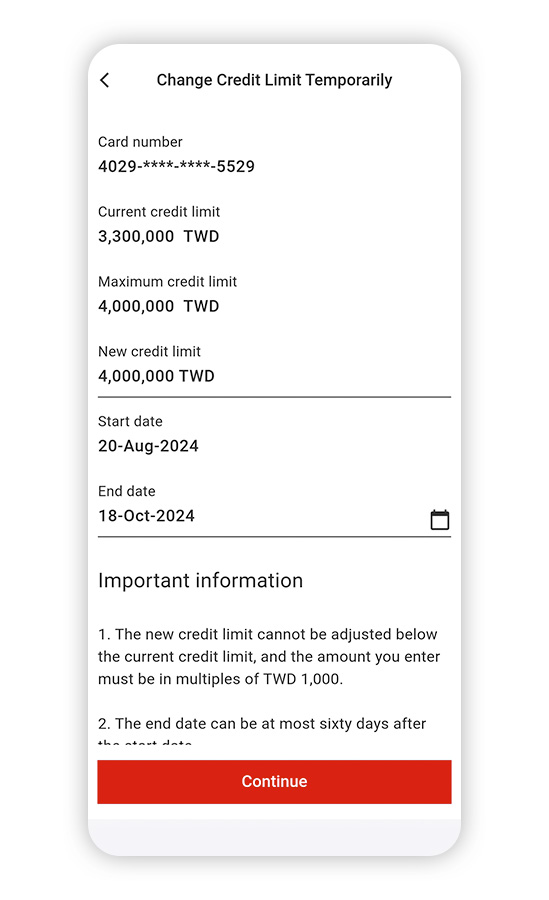

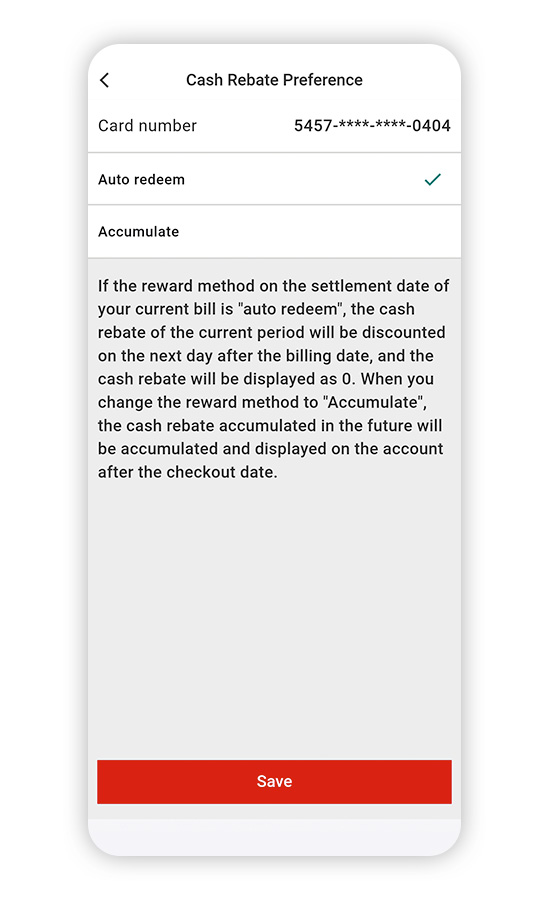

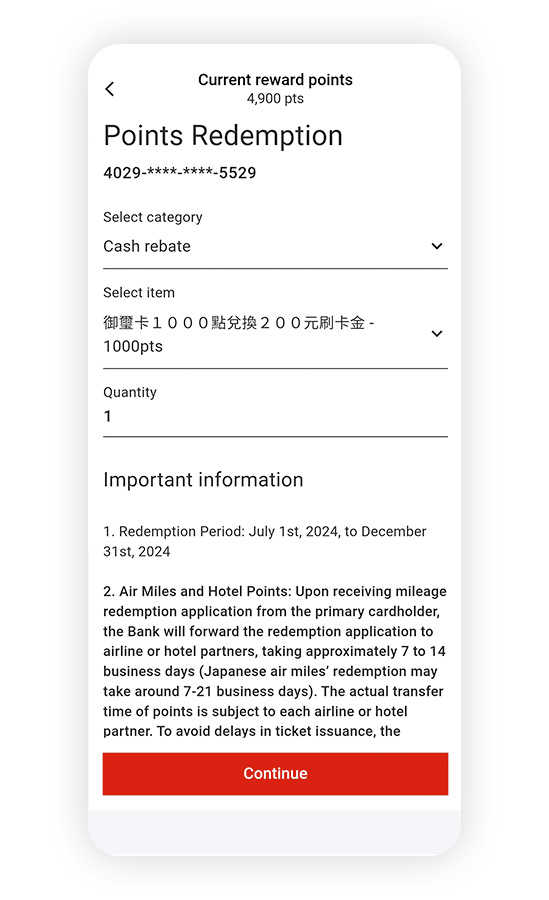

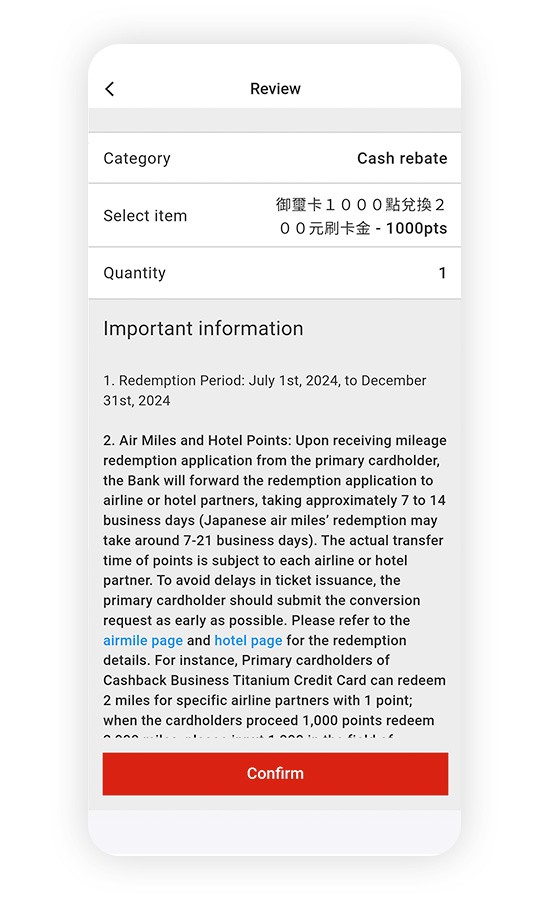

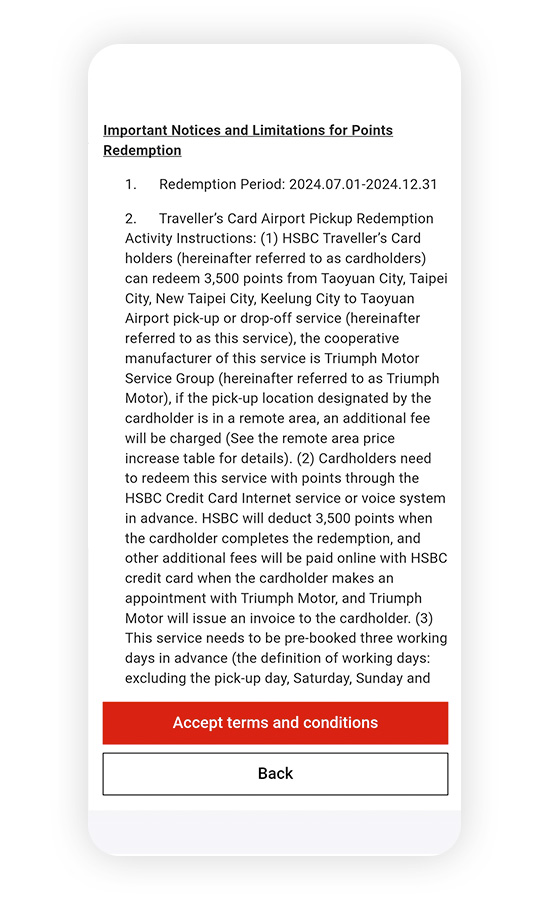

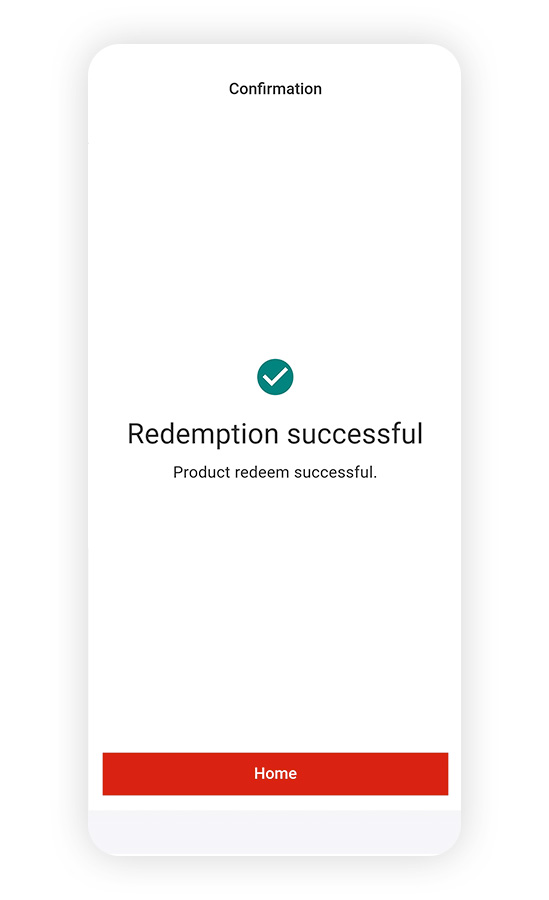

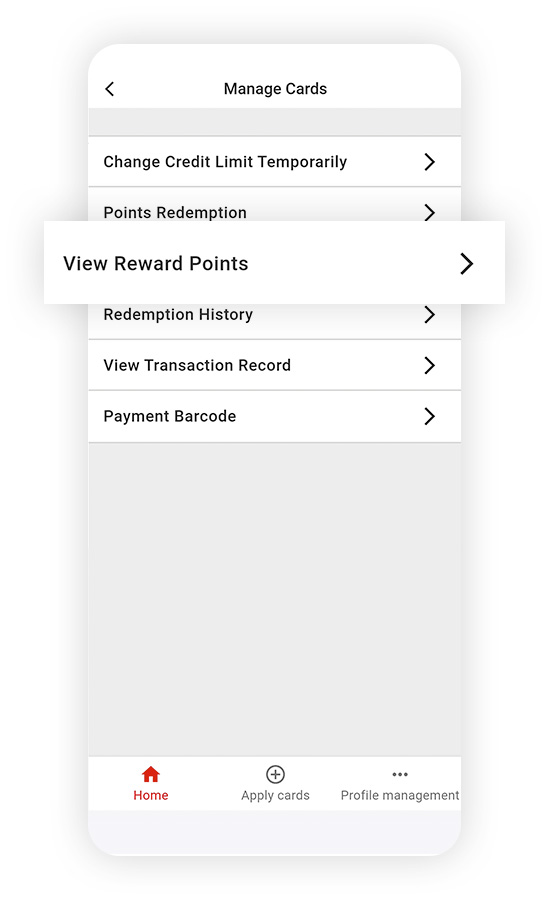

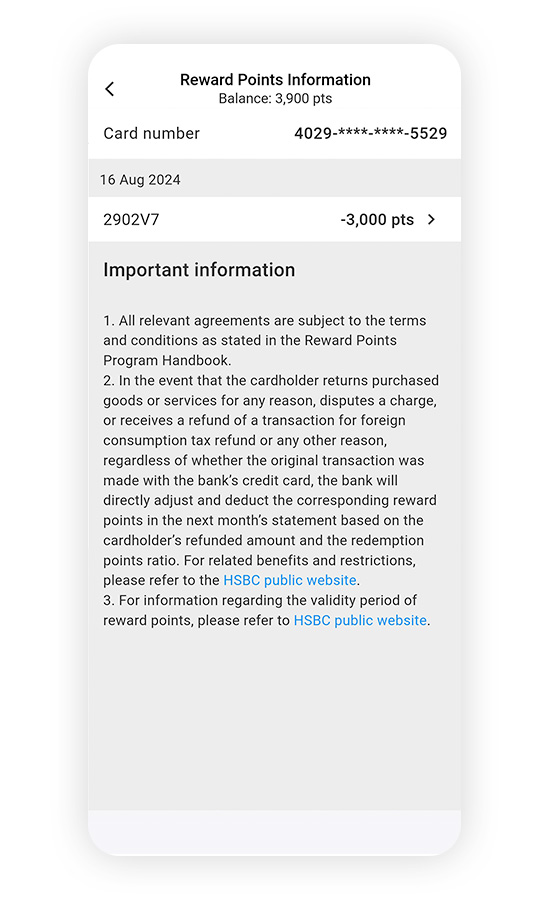

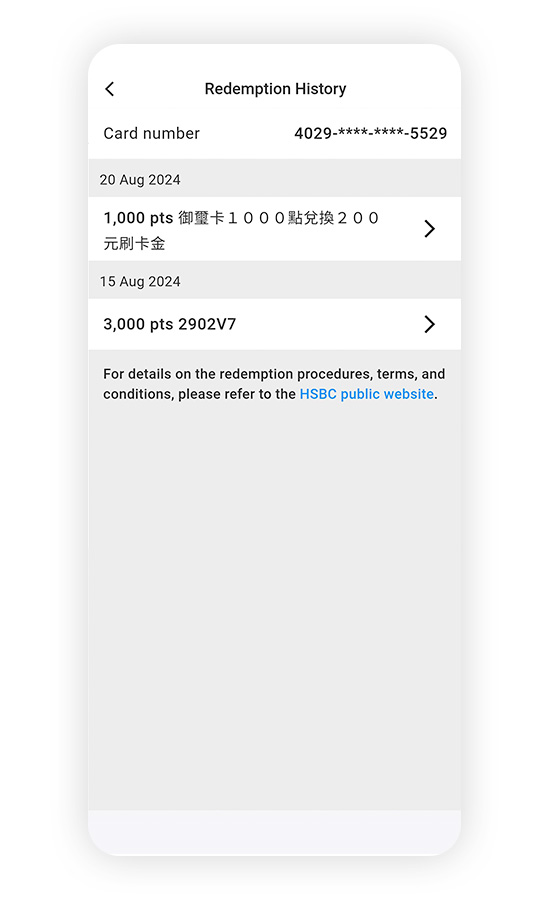

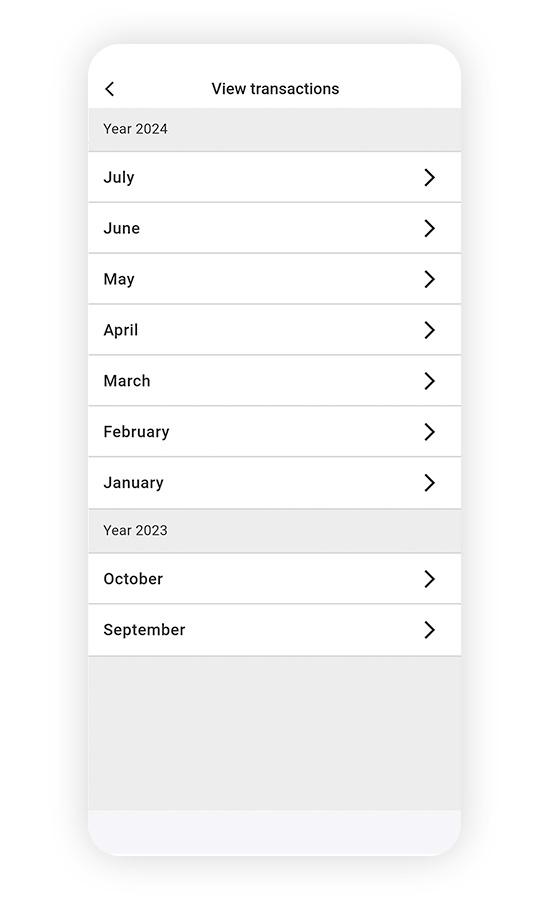

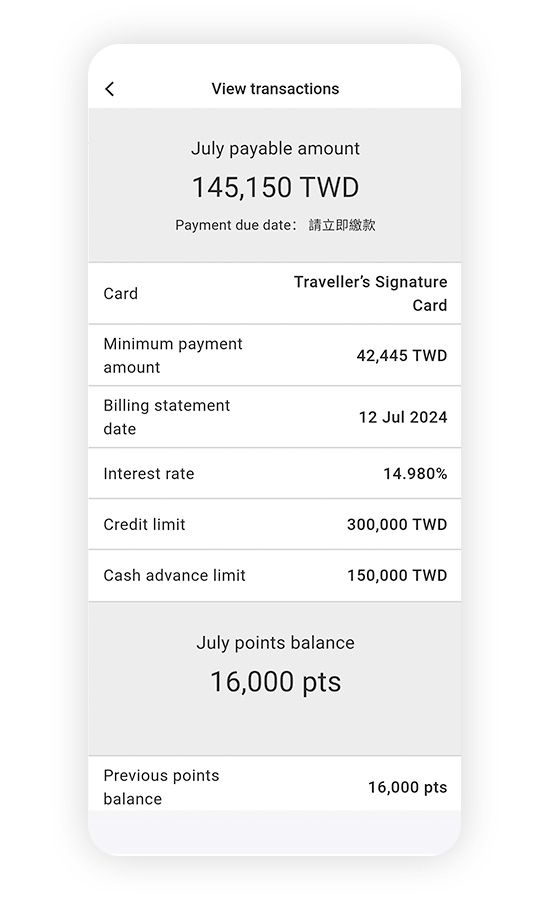

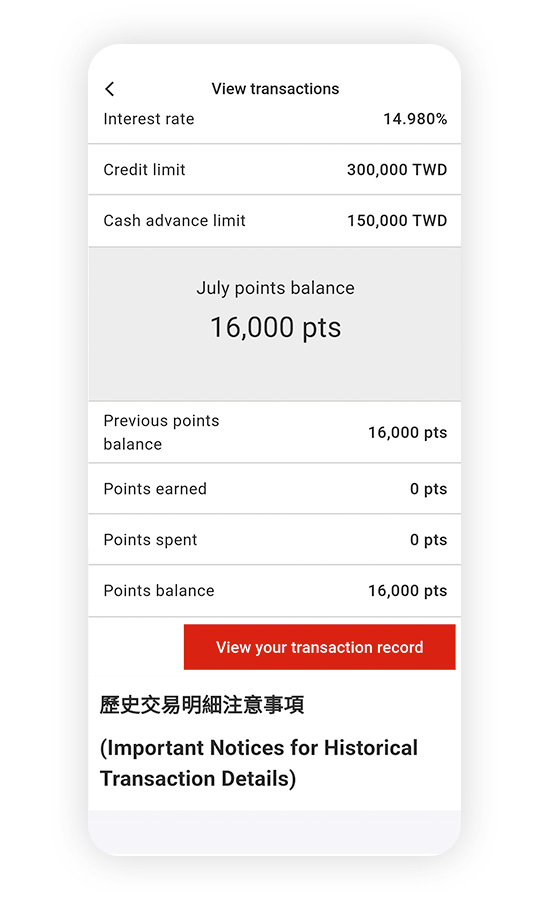

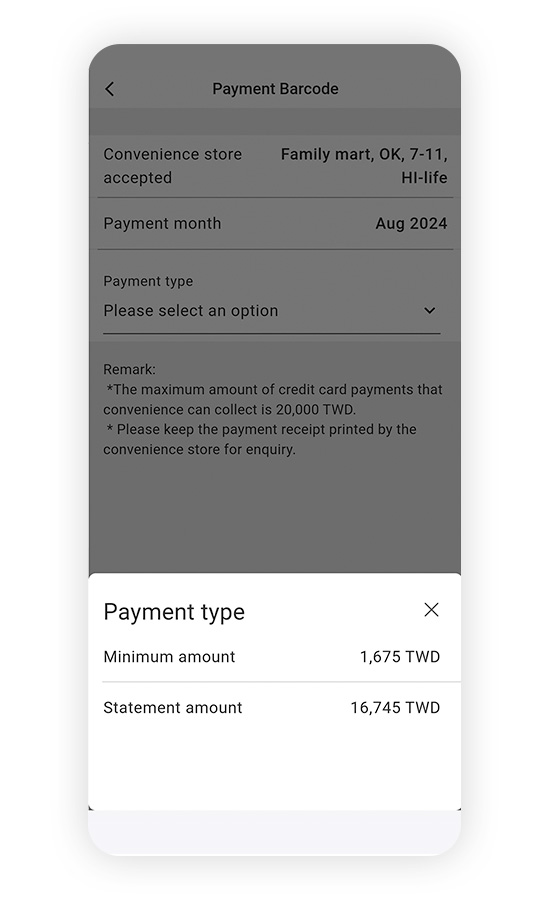

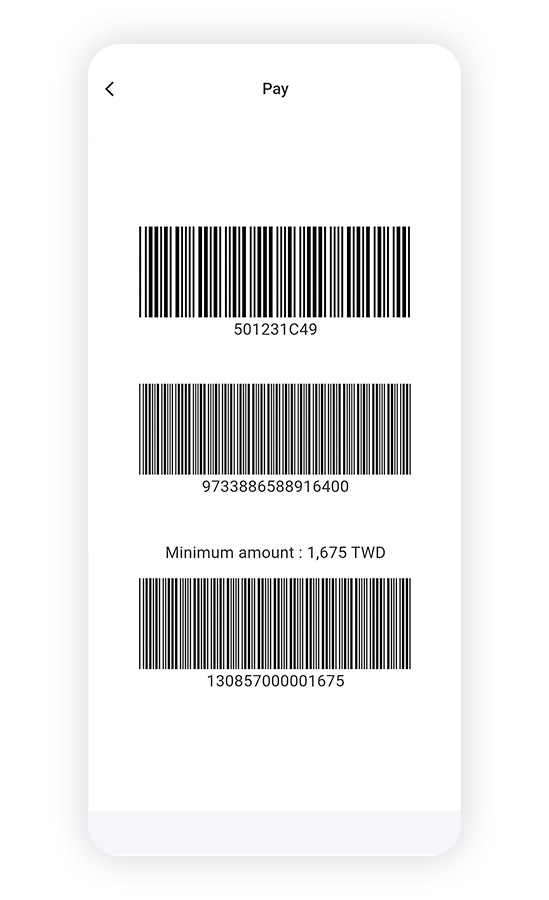

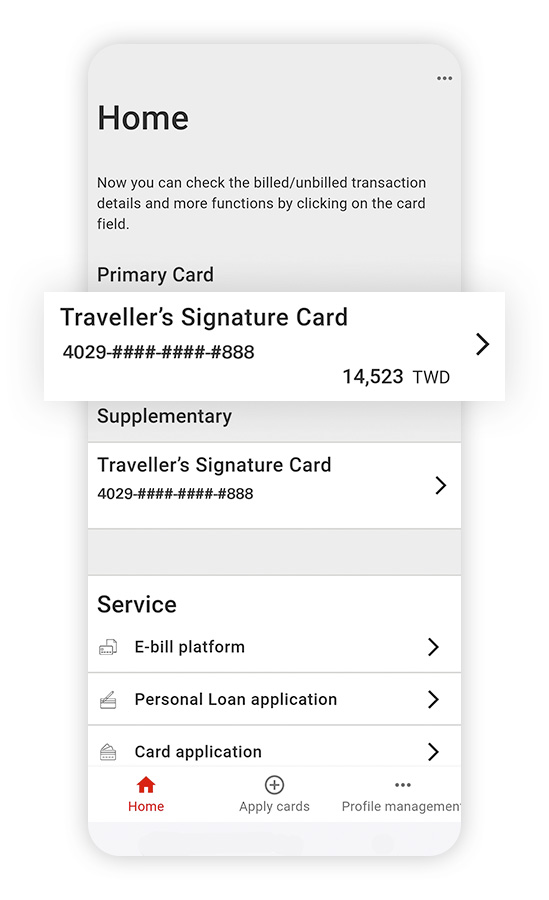

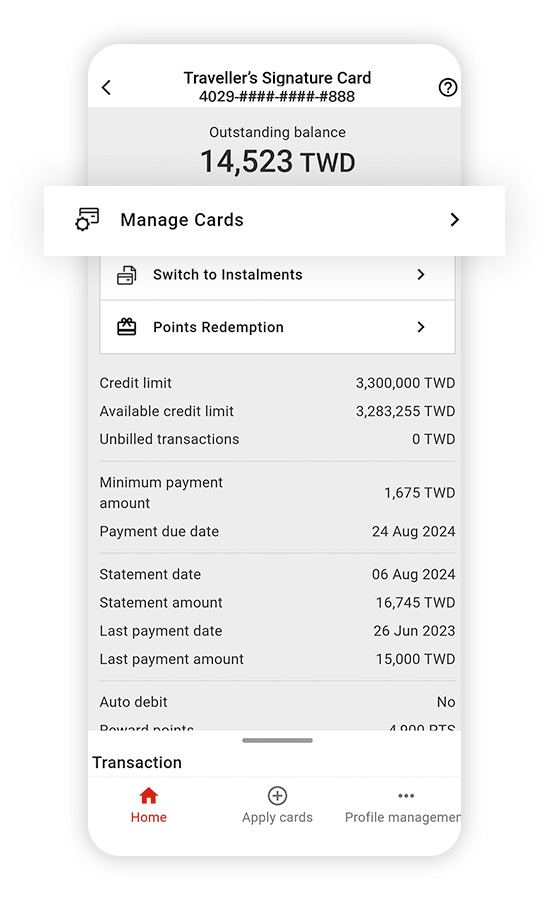

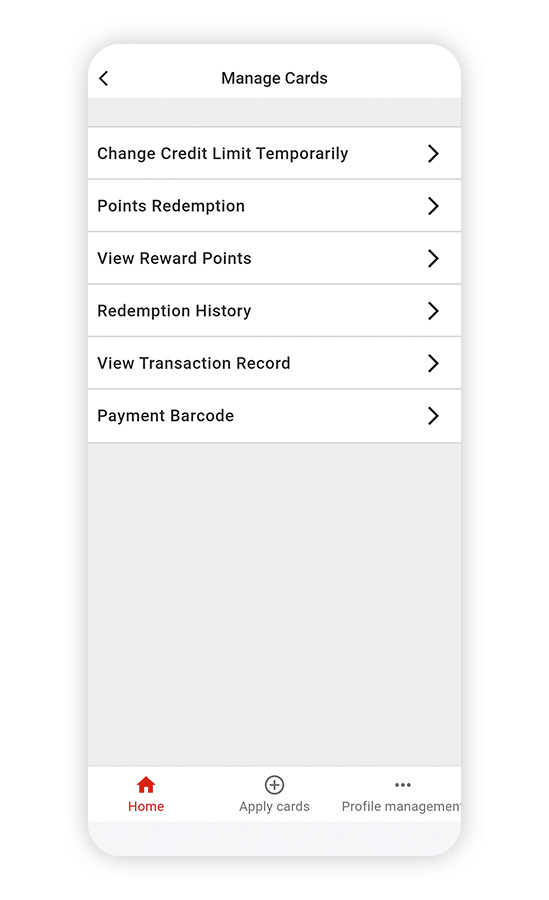

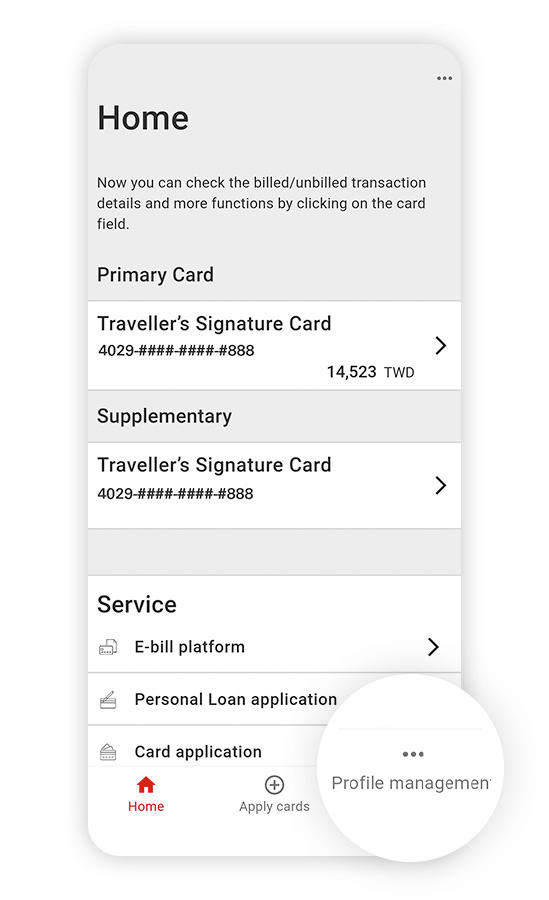

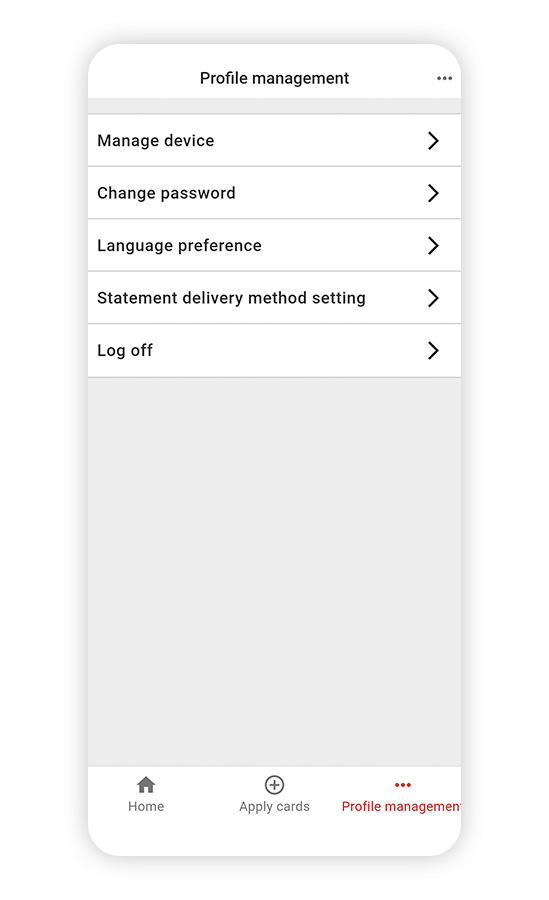

After you logged in to the Credit Card App, you can click the card field to proceed with functions and features like card overview, account information, transaction records, instalment payments, temporary credit limits, cash rebate preference, and reward points management, you can keep track of your credit card usages no matter when and where. You can also click into Profile management for other settings.

Click the field of credit card number you want to query or symbol ">" next to the card number to review the relevant information.

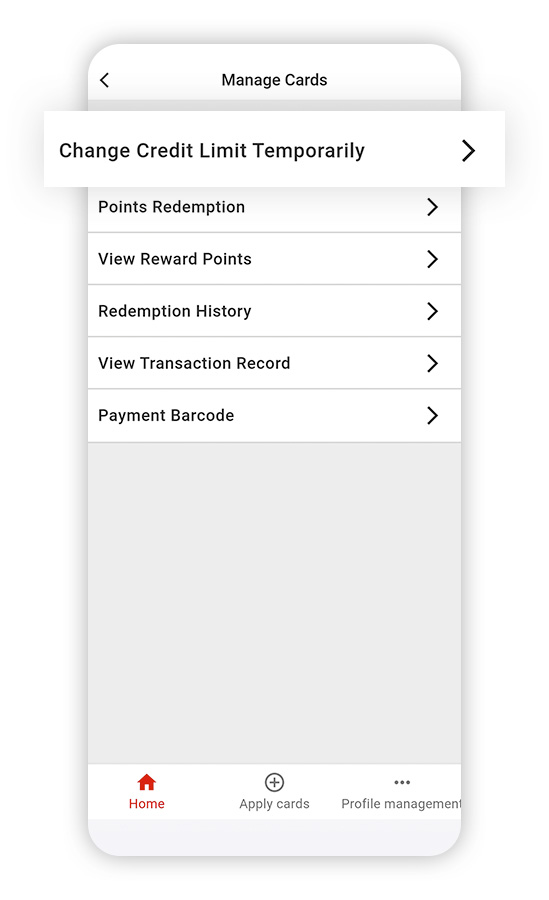

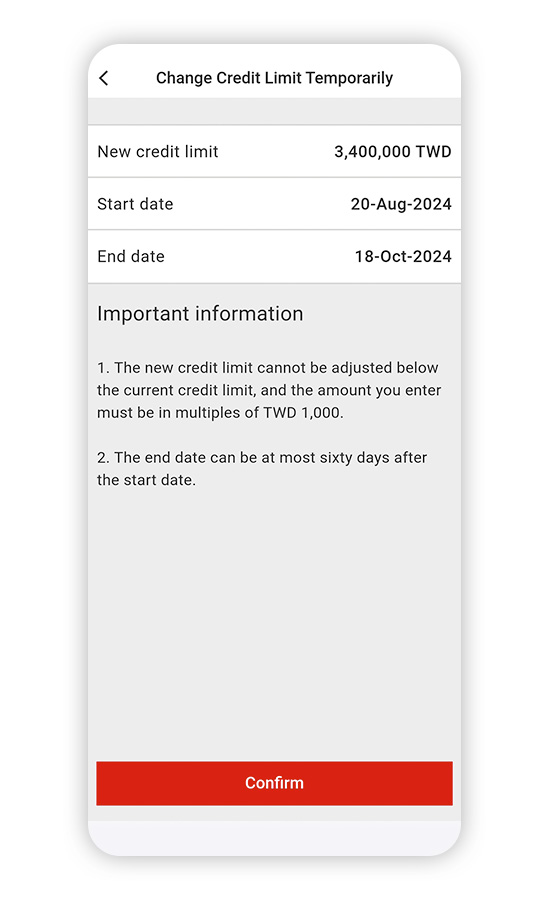

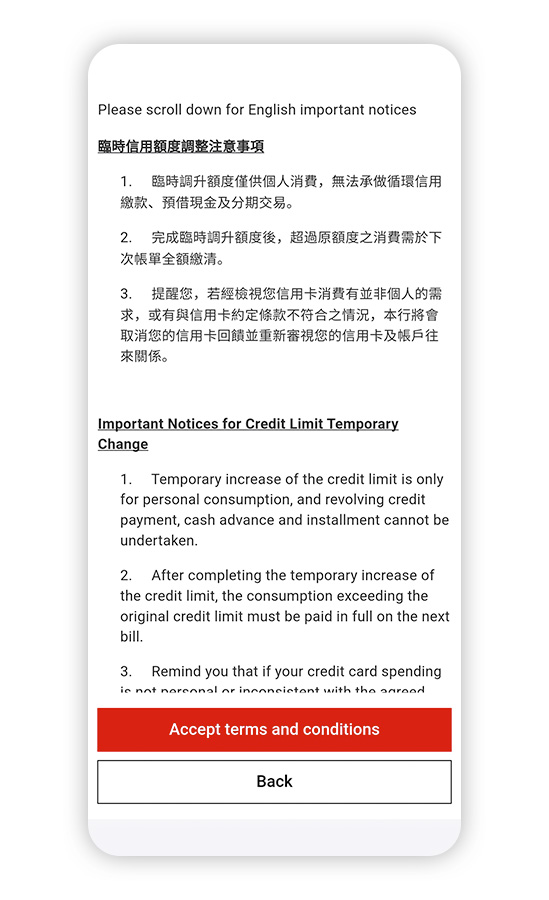

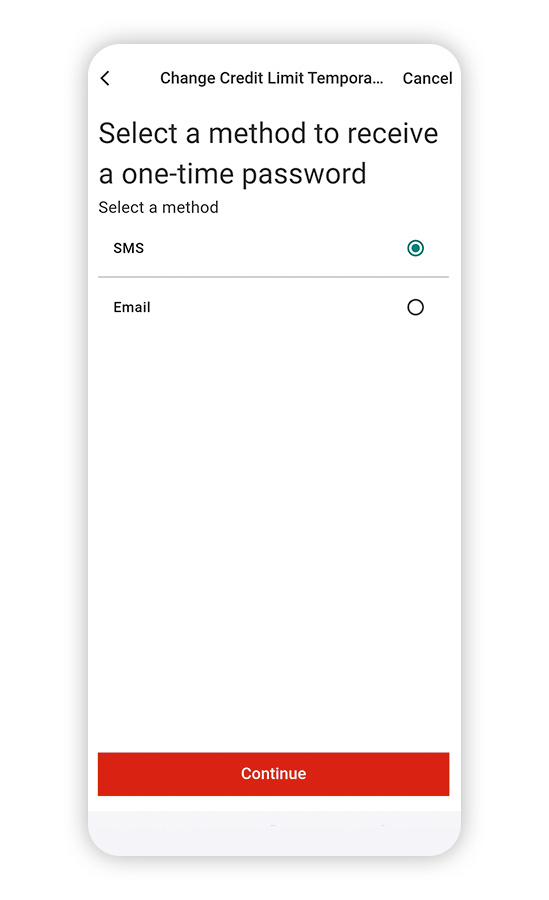

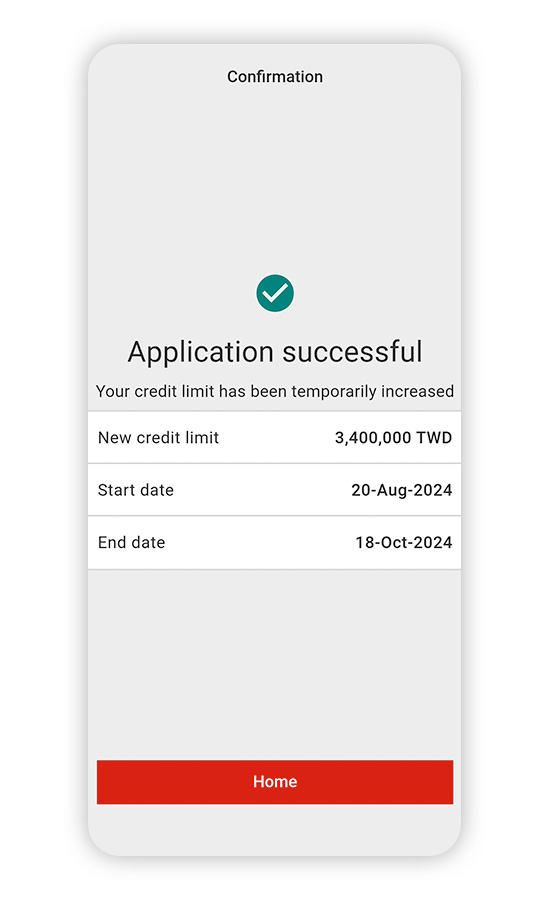

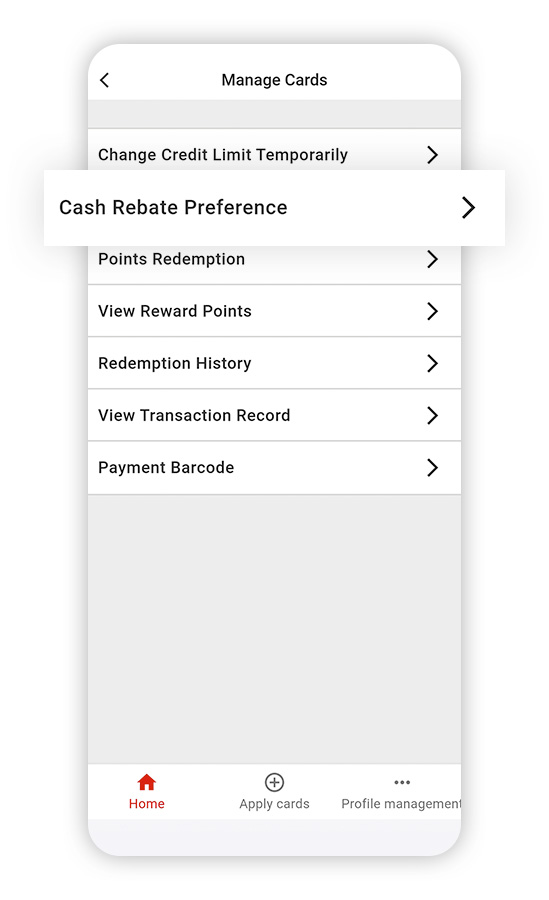

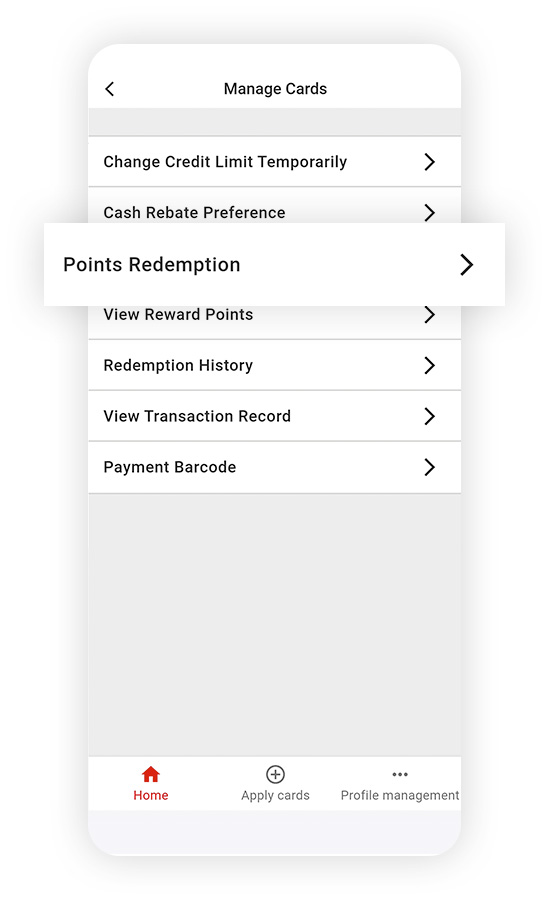

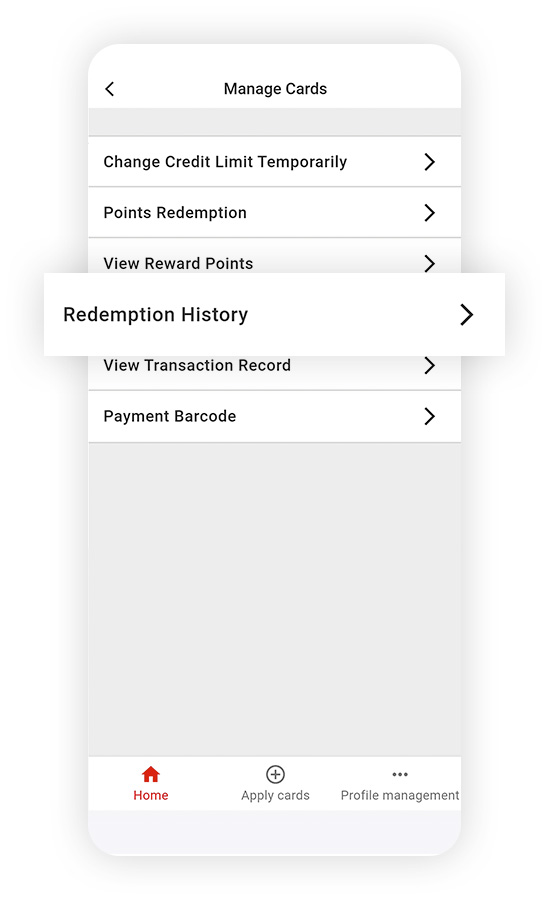

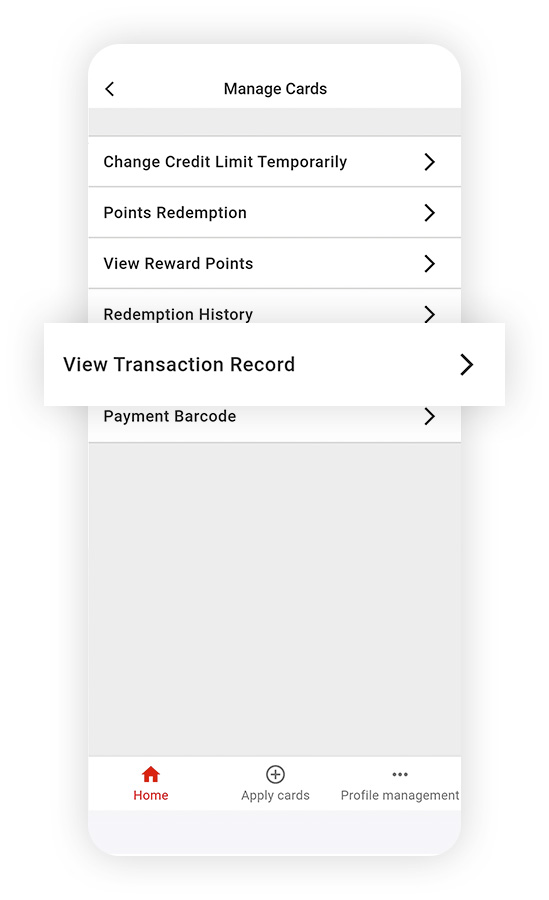

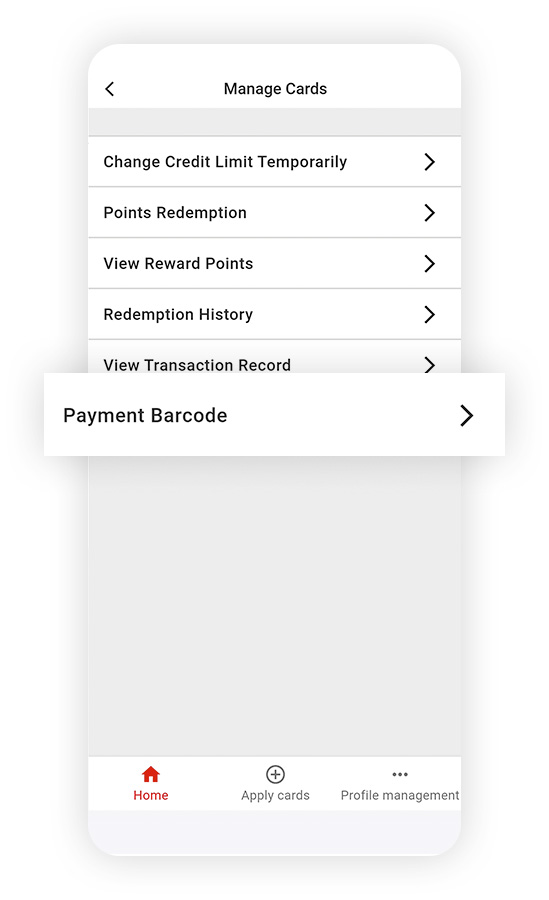

After clicking Manage Cards, you can select functions such as Change Credit Limit Temporarily, View Transaction Record, etc.

For introduction of the listed functions, please click Service Function for details.

After clicking Profile management, you can select functions such as Manage device, Change password, Language, Statement delivery method setting, etc.

Registration-related Questions

Log-in-related Questions

Message One Time Password (OTP)

Forget your username/password

Credit Card Activation

Account and Reward points

Compatibility

Bio Authentication

Device Binding and Transfer

System Usage

Other ways to bank

Please manage your finances carefully and value your credit. Interest on revolving credit and cash advance 5.68% to 15.00%. Service Charges for cash advance NT$100 + the amount of cash advance * 3.5%. Base date of interest on revolving credit: September 1 2015.